Online prop firm challenges don’t work how you think they do. After this article, you will view them in a completely different way.

Drawdown To Profit Target Ratio

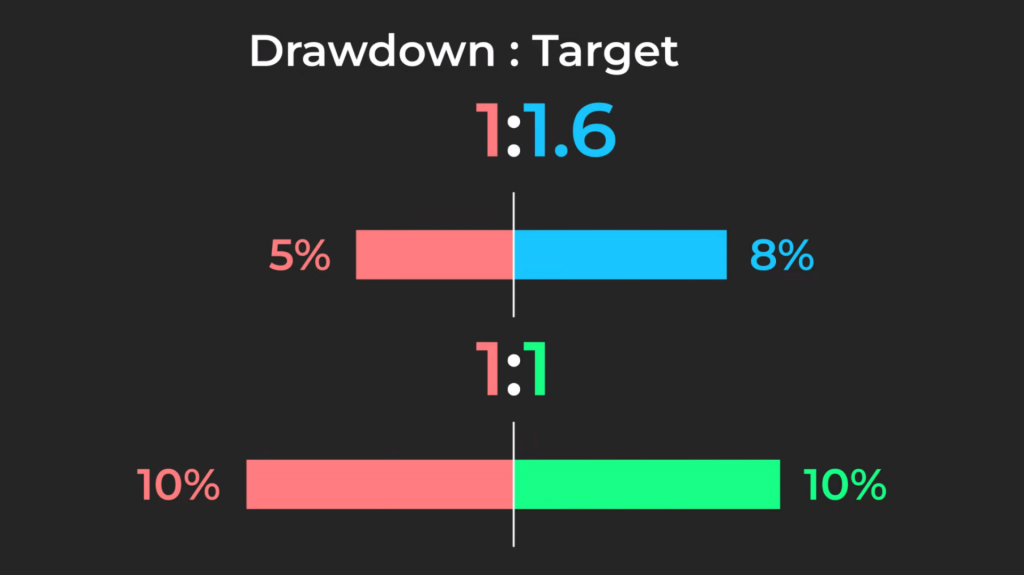

Let’s start with an example. Say you have two challenges, one with a profit target of 10%, and another with 8%, which is easier?

What about if there is a challenge where the profit target was 100%, so you had to double your account in just 30 days?

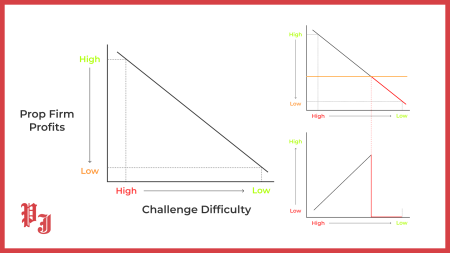

It’s easy to think the lowest 8% target but the reality is the difficulty of a prop firm challenge relies on many other things, most importantly maximum drawdown. Let’s take the FTMO challenge, with a 10% profit target and 10% maximum drawdown. This is a drawdown to target ratio of 1:1, meaning for every dollar of maximum drawdown allowed you have 1 dollar of profit target that you must make.

If a different challenge had an 8% profit target, but only had 5% maximum drawdown, the ratio would be 1:1.6, meaning it’s actually harder to pass.

But what about a challenge where you had to double your account but had a 100% drawdown limit? Would you take this challenge? Well actually, this has the same 1:1 drawdown to profit target ratio as the FTMO challenge, so it is the same difficulty (ignoring buying power). It could be argued this is actually what the FTMO challenge is, as on a 100k account you only have $10k of drawdown which you must use to make $10k profit.

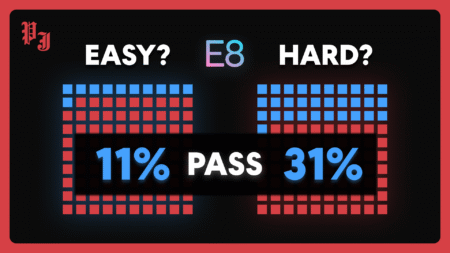

Here are the drawdown to profit target ratios of some popular prop firms in the industry.

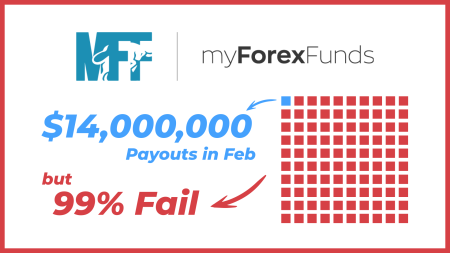

As you can see, my forex funds has the lowest ratio, so is the easiest target. Obviously, there are other factors that go into choosing a prop firm like the cost, but if you can get funded most firms refund the evaluation fee.

What Is The True Size Of Prop Firm Funded Accounts?

But when you are funded, how much money have you actually been backed by? Is a 100k funded trader actually a 6 figure trader? If you were to risk ‘1%’ of your account per trade, you’re actually risking 10% of your 10% drawdown.

This is why maximum drawdown is such an important factor when choosing a prop firm. That multiplied by the size of your account is how much you can afford to lose before your account is gone, so it’s the true value of money that you’ve been backed by. The only difference is that you have the buying power of the original account size, but this can lead to overleveraging of the balance that you’re actually allowed to lose.

Prop Firm Challenge Daily Maximum Drawdown

Many traders also complain about the max daily drawdown that many prop firms enforce of 5-6%. But this is equivalent to losing more than 50% of your true backing in one day, which should never happen if you realize this and use sound risk management.

Should You Try Prop Firm Challenges?

So knowing this, should you even join prop fund challenges and try to get funded? While prop firm challenges might not be what they first seem, there are some incredible positives of getting funded.

For a start, once traders receive their first profit split, most firms refund the challenge fee, meaning the account is completely risk-free. Also, free retries mean traders who are confident in making at least some profit each month can keep retaking the challenge until they reach the profit target at no extra cost.

Then, once funded, while traders only have a small amount of the account that they can actually lose because they are risk-free of their own money, they can use more aggressive risk management to make larger profits. The account scaling plans then allow consistent traders to earn even more funding at no extra cost.

But remember, in order to earn a profit split and get your money back you need 3 months of profit in a row. And as shown by my last video, the number of traders who actually achieve this is extremely low. For experienced traders prop firms offer a great opportunity to increase their profits and reduce their risk. But for inexperienced traders, trying to get funded will be a hard lesson that they will learn when they lose their money.