Funding Ticks has just announced that it is closing down. The Futures prop firm has struggled with controversy in the past month, and after ruining its reputation, customers started avoiding its challenges, so continuing operations became unsustainable.

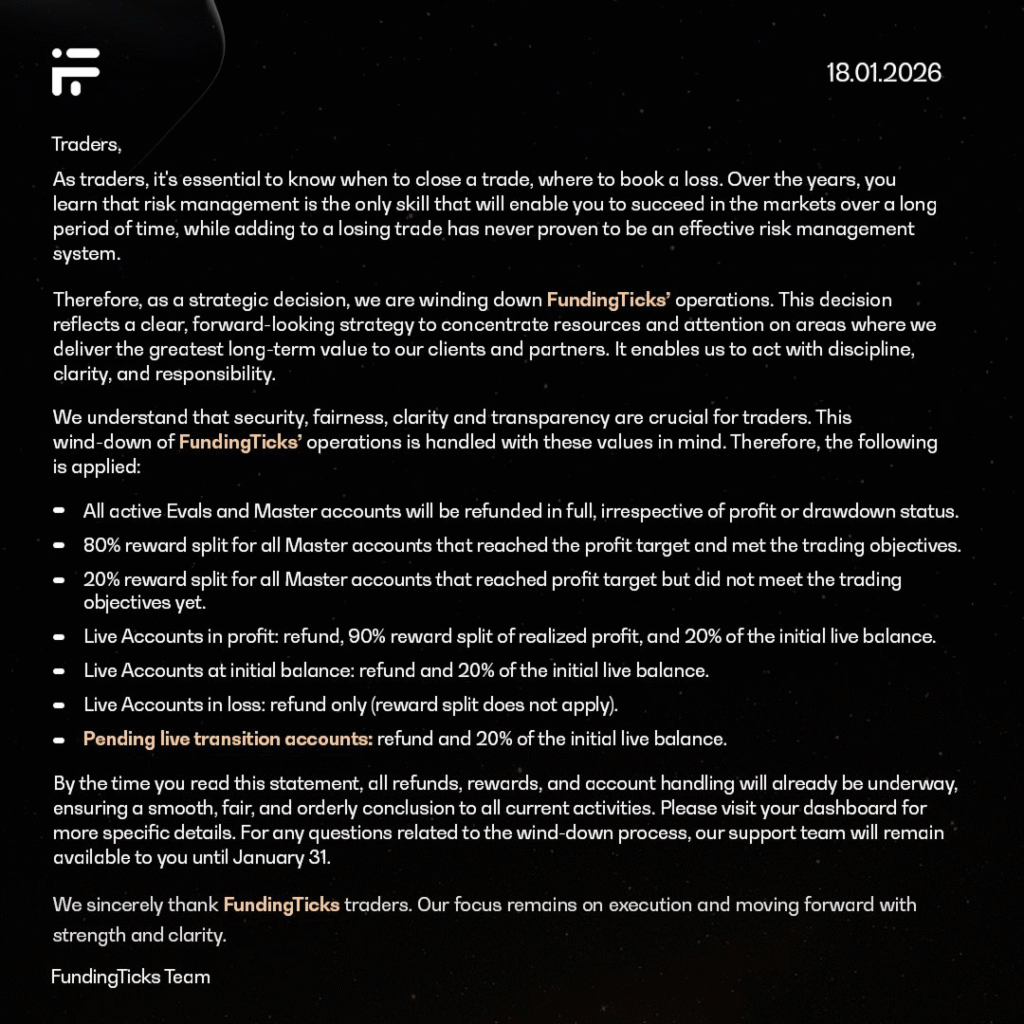

It has offered refunds for all active accounts, as well as payouts for some funded accounts, but traders will still be upset that this is the last profit split they earn from the firm. Note that it’s only Funding Ticks, the futures firm that is closing, meanwhile Funding Pips, its sister CFD firm will continue operations.

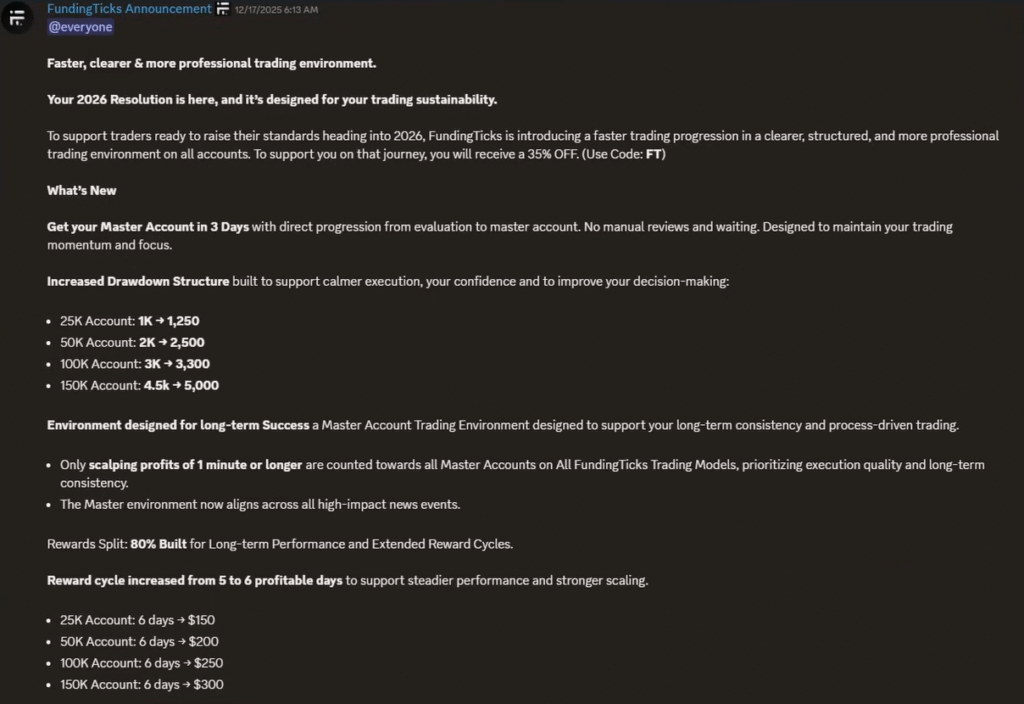

The downfall of Funding Ticks started with a conscious decision to retroactively change rules on already purchased accounts. On December 17th they announced that all profits from trades less than a minute long would be deducted.

This even applied to trades that had been taken before the announcement, so traders had no time to react. Some traders even lost their accounts because of the rule change. This was paired with a reduced reward split from 90% to 80%, and increased cycle length from 5 to 6 days. Drawdown was increased, but traders were focussed on all the negative changes that they hadn’t signed up for.

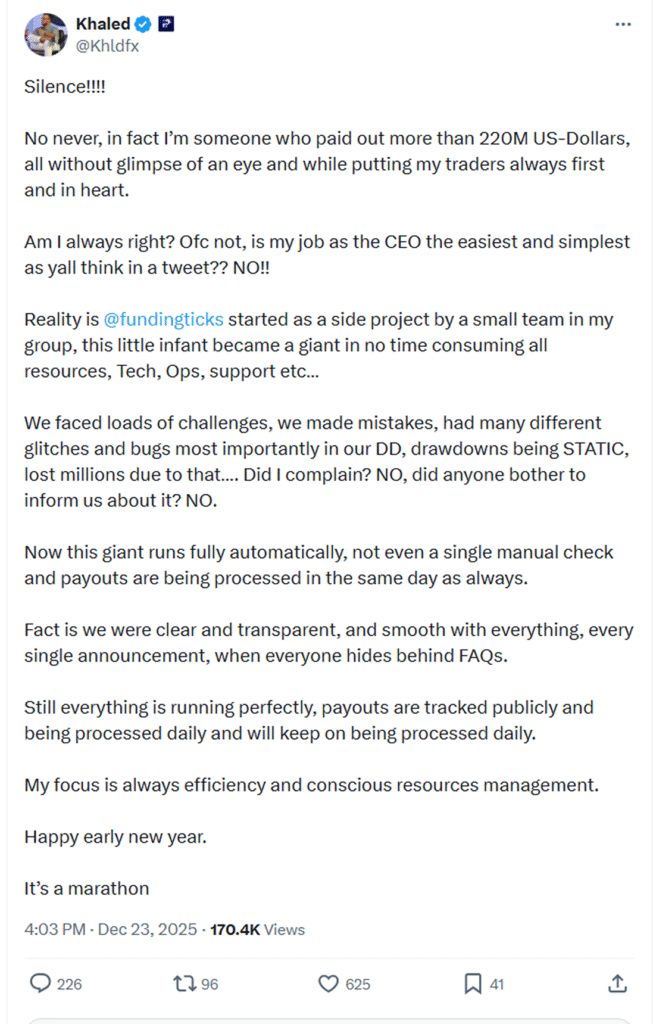

Not only had the team made a massive mistake by trying to carry out retroactive rule changes, but their response to the public backlash was disappointing as well. There was no response until 6 days after the announcement, when CEO Khaled posted an erratic tweet starting with Silence!!!.

He didn’t apologise, instead claiming that they were clear and transparent. This is simply incorrect. Yes, the changes were in the announcement, but this announcement was only on social media, Funding Ticks traders were not sent an email explaining the changes. In the reply to his first tweet Khaled says he takes full responsibility and full ownership and that he’ll do better, but still offers no apology to the affected traders. The day later he tweets ‘I’m working, you’ll be happy’. Finally on the 27th it’s decided that all HFT profits made before 16th December will be reinstated, but the HFT rule will remain from the 17th onwards.

This was not an acceptable solution, as traders didn’t sign up for this HFT rule when buying their accounts. Prop Firm Match had contacted Funding Ticks about the rule changes, and rightly delisted the firm after the response was only a partial fix.

Then just a few hours ago, Funding Ticks announced that it would be closing. All active accounts will receive refunds, which is a respectable decision. Master accounts that reached the profit target and trading objectives will receive an 80% reward split, and master accounts that reached the profit target but have not met the trading objectives will receive a 20% split.

Live accounts will receive a refund, a 90% reward split of realised profit, and 20% of the initial balance. Live accounts at the initial balance will receive a refund and 20% of the initial balance. Live accounts in a loss will only receive a refund.

Funding Ticks had entered the industry with a very competitive offering, but it turned out that this was unsustainable. It’s likely that Funding Ticks was already struggling in December, which is why they made the retroactive rule change. But making the rule change ruined their reputation, essentially dooming the company’s future. And while its sister company Funding Pips will continue operations, the downfall of Funding Ticks makes the firm riskier.