Funding Ticks shut down this week, hurting thousands of traders across the industry. And while refunds and payouts will be provided, this isn’t the first shutdown to happen, with many others leaving traders with no compensation. The prop firm industry is still growing and volatile, meaning more prop firm shutdowns are inevitable. So in this video I’ll provide 6 tips on how you can protect yourself from future prop firm shutdowns.

Don’t spend money you can’t afford to lose

Firstly, the most important of them all, don’t spend money you can’t afford to lose. Prop firms are a high risk financial instrument. Most traders who buy challenges lose money. And even if you’re the exception and are profitable, you still could lose all the money you put in if the firm shuts down. So make sure you’re comfortable with losing this money, and have an alternative source of income that will protect you if the industry has a downturn.

Diversification

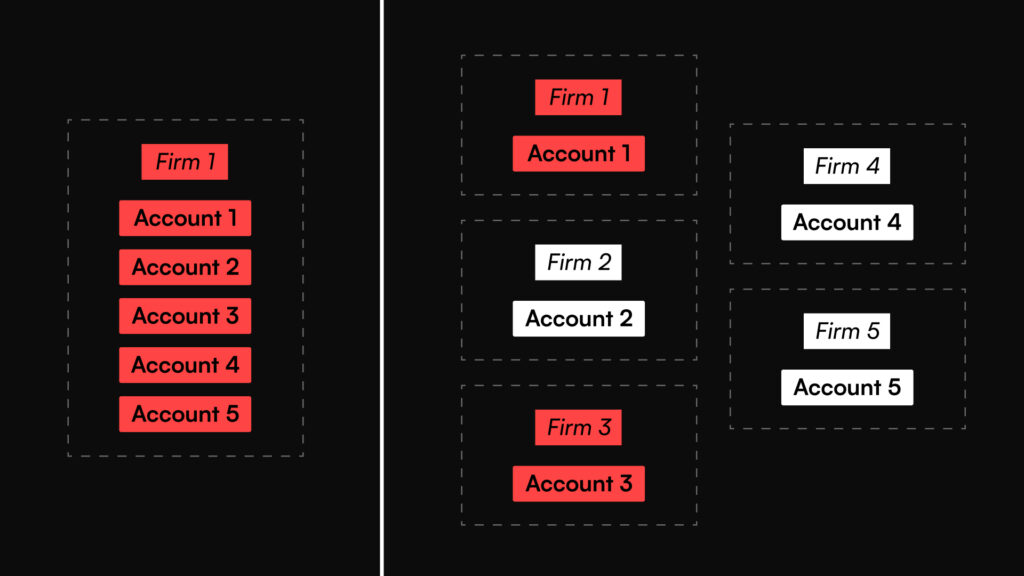

Second, diversification is the next best way to protect yourself. Diversify across both trading firms and trading platforms. 5 accounts across 5 different firms are far less likely to all go down at once than 5 accounts with a single firm.

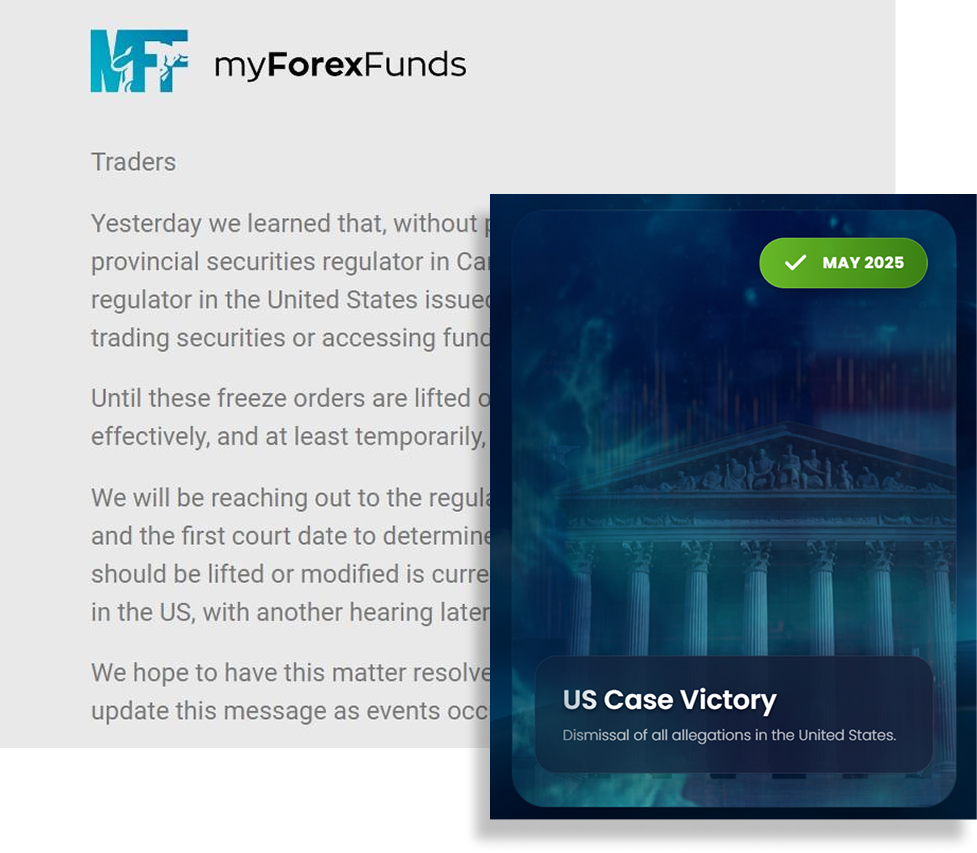

Even if you think you know which firm is the most stable, putting all your eggs in one basket isn’t the way to go. The My Forex Funds case demonstrates that factors outside a firm’s control can rapidly impact its operations.

Diversifying across trading platforms is also beneficial. Using multiple platforms like Metatrader, cTrader, and Match Trader simultaneously means that if one platform bans prop firms, you’ll still be able to trade your other accounts while a replacement platform is being sorted out.

Research (well)

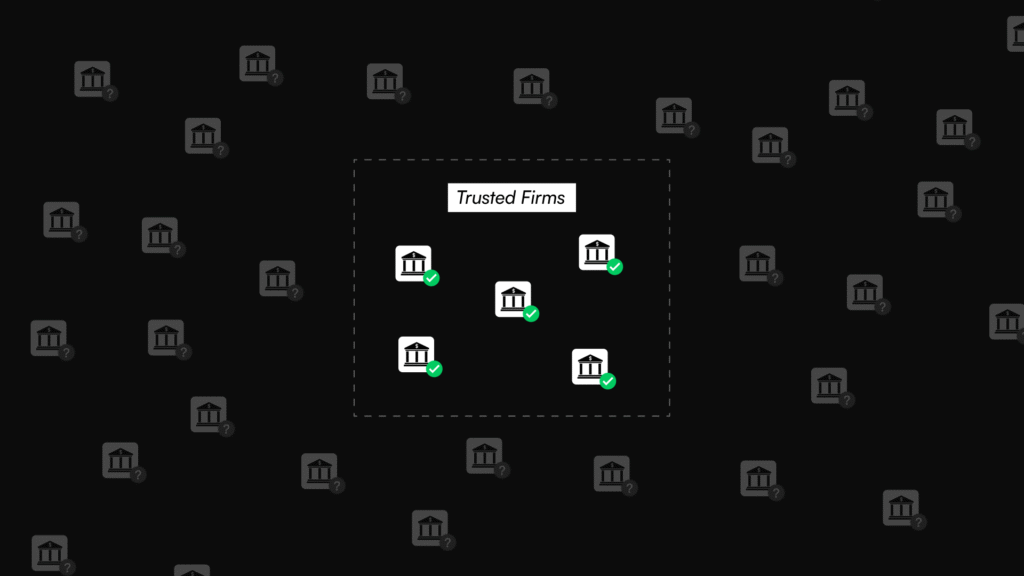

And while diversification is important, you should only trade with a select number of firms, don’t try to trade with every single one. Make sure you do proper research into each firm, and build a list of firms that you can trust.

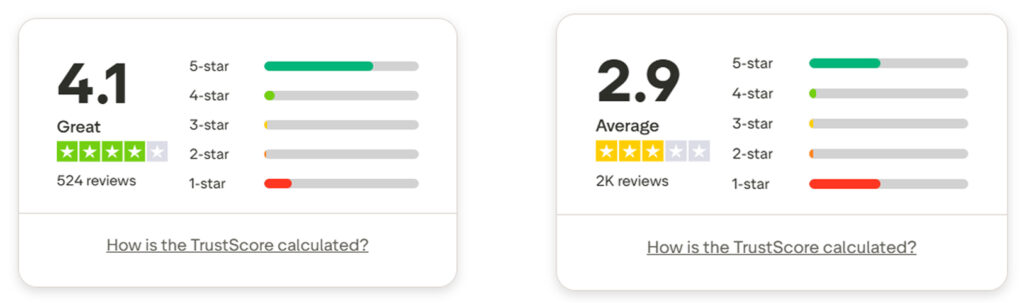

Check each firm’s reputation and look for any controversies in the past. Check that a firm’s owners are public figures, and not just anonymous accounts that could abandon the company at any moment.

Firm age is very important too. Older firms have proven they’re not a pump and dump scheme, and are typically more stable. Years of operation don’t guarantee the firm will be trustworthy, but aiming for firms that have been stable for 2 or more years is a good rule of thumb.

Think – is this offering too good to be true?

Another way to protect yourself is to ask the question – is this too good to be true? If it looks too good, that’s a warning sign.

Prop firms are a business that need to balance challenge attractiveness and profitability. If a firm tries to attract customers by making a challenge that is too easy, they’ll get money in the short run, but won’t be able to pay out in the long run.

Take only one challenge at a time

Also when trading prop firms, take one challenge at a time. Don’t be tempted by fomo and the endless promotions being bombarded at you. If you end up stockpiling challenge accounts, there’s a huge amount of money at risk if the whole industry gets impacted by something like regulation.

Instead, take one challenge at a time, and only buy another once you get funded or fail the account. Also, buying challenges one by one allows you to take time to assess each firm again before making the purchase.

This prevents you from being locked into a company that looked solid two months ago but is now showing cracks in its stability when you get to trading the challenge.

Have a personal brokerage account

Finally, put some of your prop firm profits in a personal brokerage account. If you’re actually a profitable trader, this money will grow and be an income source that’s immune to prop firm turbulence.

Conclusion

Thanks for reading, I hope you found these tips helpful. For more of my content, check out other prop firm articles and my YouTube channel.