Analysis

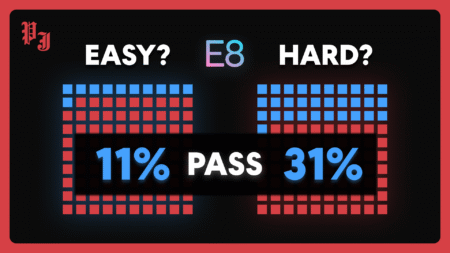

E8 markets have just released pass rate stats for their prop firm challenges. But the results are surprising, and are being used as justification…

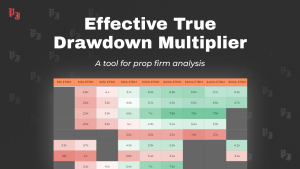

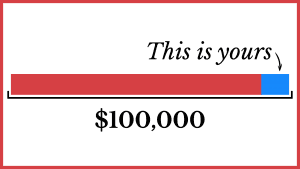

Learn how to calculate the value for money of a prop firm challenge using the Effective True Drawdown Multiplier formula!

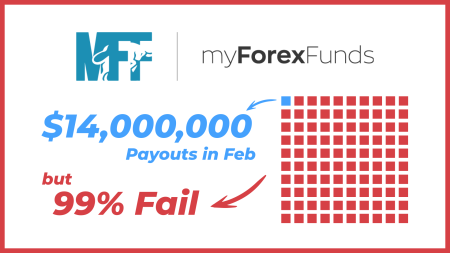

Excessively easy prop firm challenges could be a double-edged sword, leading to problems for both the firm and the trader.

Prop Firms

OTHER

Subscribe to Updates

Sign up to be notified when we publish new posts - only quality content, no spam.

© 2026 The Prop Journalist