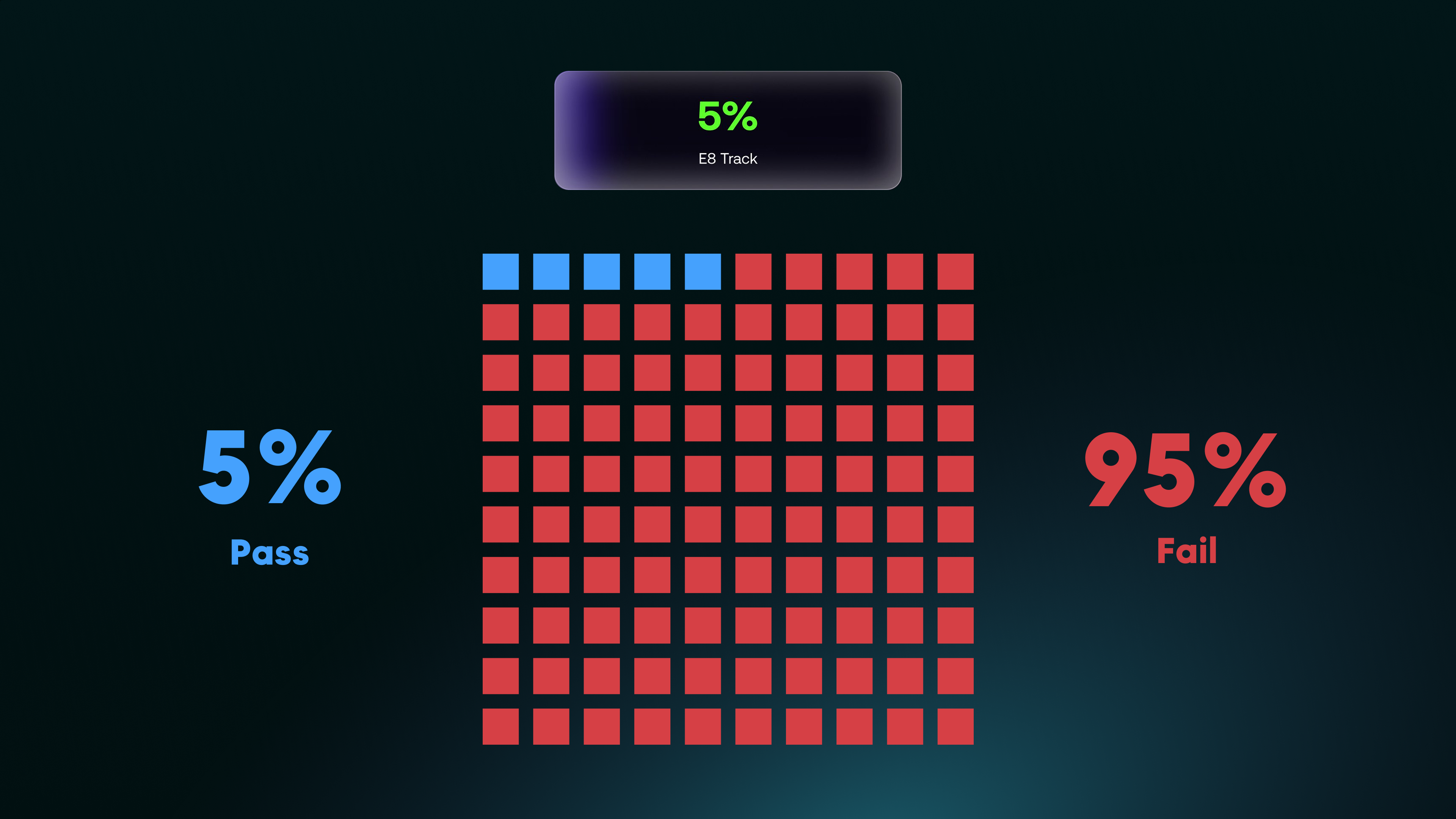

E8 markets have just released pass rate stats for their prop firm challenges. But the results are surprising, and are being used as justification for pausing the E8 Classic and Track challenges. In the post, Andrew from E8 made a few comments that I disagree with as well, so let’s break down the data to see if we can understand what’s really happening.

E8 Trading Pass Rates

The pass rates were:

5% for the E8 Track

11% for E8 classic

26% for E8 One

31% for E8 signature

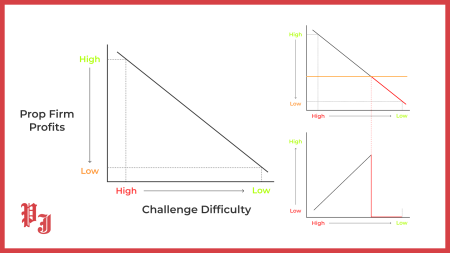

Meaning the 3-step challenge had the worst pass rate, 2-step was in the middle, and the 1-step challenges had the best pass rates. The 3-step challenge having the lowest pass rate is not a surprise as adding additional steps makes a challenge harder to pass.

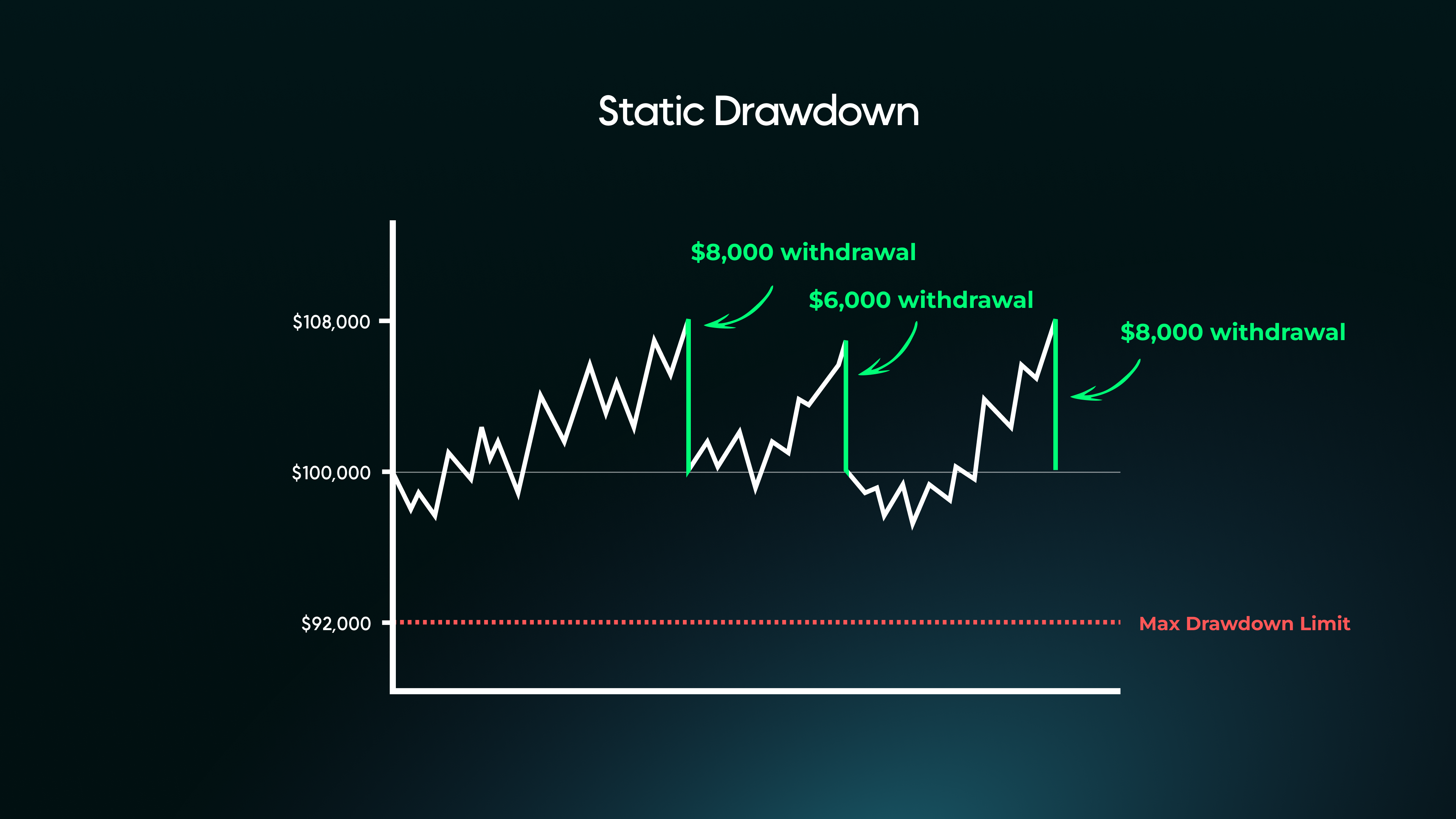

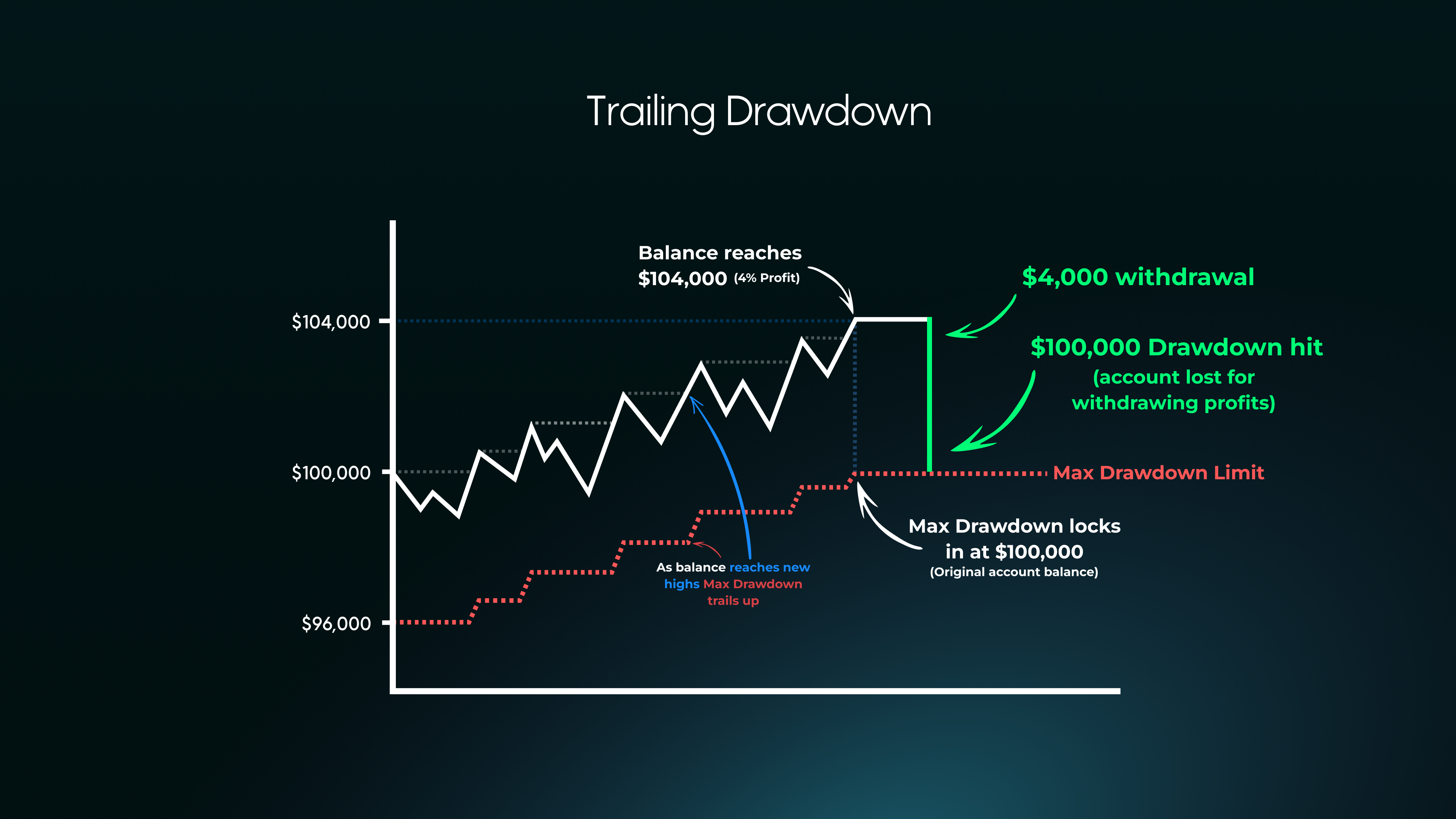

Following that logic, it makes sense that the next hardest challenge to pass is the 2-step, and the 1-step challenges are the easiest. But these huge differences in pass rates don’t seem to make sense, given the challenges have similar required return, and 2-step actually has the advantage of larger static maximum drawdown, while the 1-Step challenges have trailing. In particular, the E8 signature challenge stands out with the highest pass rate, despite having the highest true return to pass.

Simple Trading Model

To understand if these pass rates are realistic, let’s create a simple model.

We will assume that the average trader is breakeven. In reality, after spreads and commissions, most prop firm traders are actually unprofitable, but factoring in the very few outliers of profitable traders, modelling using a breakeven strategy is a fair approach.

The breakeven strategy has a 50% winrate, earning 1% on a win and losing 1% on a loss.

2-Step Classic Model

Modelling the pass probability on the 2-step with static maximum drawdown is the easiest. This is a random walk with absorbing barriers, resulting in a 50% pass rate for Phase 1.

Looking at the challenges without calculations, this is also intuitive. The phase has an 8% profit target and 8% Maximum Drawdown, and the strategy is breakeven, so a 50% pass rate makes sense. The second phase has a 66% pass rate, meaning the challenge as a whole has a 33% pass rate.

But compare this to the actual 11% pass rate, what’s going on? The difference is because the model is calculating a model pass rate.

We’re being generous modelling with a breakeven strategy, and we’re not taking into account all of the challenge’s rules. So the difference between the model and actual pass rates can be explained partially by traders being worse than our model, and also by losses due to rules like daily drawdown.

1-Step E8 One Model

When we start to model the 1-step challenges, this is where things get interesting.

The E8 One challenge has 4% trailing maximum drawdown, which trails with new balance highs, until it locks in at the original account balance. Using the model, the probability of reaching 4% profit and locking in the trailing drawdown before breaching the account is around 41%, then the probability of passing from this point is 66%. Altogether, the calculated model pass rate is 27%.

The actual pass rate is 26%, so there’s almost no difference. Compare this to the 2-Step, where the actual pass rate was a third of the model.

We would expect the gap to be somewhat lower in the E8 One, because the 3% daily drawdown is higher in proportion to maximum drawdown. But such a difference in gaps between the challenges is unusually large.

1-Step E8 Signature Model

The E8 signature’s End Of Day trailing drawdown makes it harder to model. Assuming that a trader passes in a single day, we can ignore trailing, resulting in a 33% model pass rate.

If we model a trader only taking 1 trade a day, this results in a roughly 21% pass rate.

So the model pass rate should be somewhere between 21% and 33%. The actual pass rate is 31%. For this to be possible, the EOD drawdown must not impact most traders, and there will be almost no gap between model and trader ability.

As the E8 signature has a soft daily drawdown breach, this will not impact the pass rate gap.

Are These Stats Misleading?

I believe that the difference in trader ability, and daily drawdown can’t fully explain the lack of a gap between model and actual pass rates in the E8 signature challenge, while the E8 Classic has such a large gap.

I don’t think that E8 has intentionally falsified the data, but these pass rate stats may be subject to incomplete data. The infographic is titled Pass Rates November 2025.

I think what E8 has done is taken all the challenge passes and fails in November, then used this to calculate the pass rate for each challenge. This may seem fine, but it’s actually a form of sampling bias. It’s only considering challenges that have been finished in November, and ignoring the ones that are ongoing. If ongoing challenges are going to eventually exhibit a different pass rate than the ones finished in November, calculating pass rate this way is misleading.

The way to calculate an accurate pass rate is through cohort analysis, for example looking at all challenges started in January this year. Once the large majority of challenges have been finished, we have a much more accurate pass rate figure.

But even with unbiased data, pass rates are shaped by selection and behavior, meaning the types of traders each program attracts and how they approach it, so they’re not a clean measure of difficulty. And difficulty is only one factor to consider with prop firms.

Andrew’s Comments

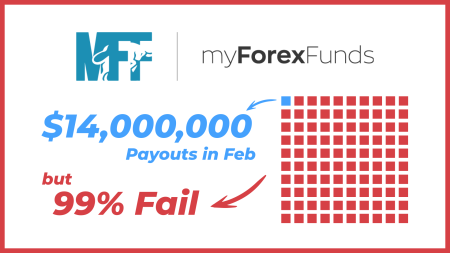

This is why I disagree with some parts of Andrew’s post. He explains that E8 removed the 2-Step and 3-Step models because of the low pass rates. He says that people believe that two-phase programs are easier because it’s a long standing narrative pushed onto the community by large firms and influencers who financially benefitted from their communities failing.

First of all, this is ironic because E8, like all other prop firms, also financially benefits when traders fail the challenge. This is just how the prop firm model works at the moment. E8 has not paused its static drawdown challenges because they are tired of earning money from traders failing, they have likely done it to limit the risk which static drawdown exposes them to.

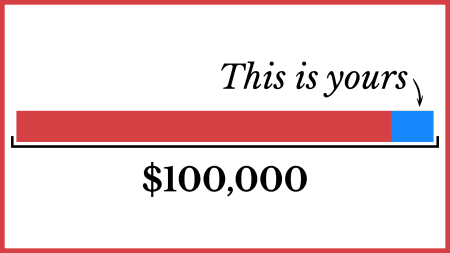

Traders with static drawdown funded accounts can continuously withdraw their profits, and on reset have their full maximum drawdown to work with.

Whereas trailing drawdown stops this, by trailing up, until it locks at the original account balance like Andrew says. What he fails to mention is that withdrawing all profits at this point leads to the account being breached.

So when a trader reaches this stage, they must risk their profits to make more money, rather than being able to withdraw and risk simulated drawdown. Paired with larger drawdown limits, this means static drawdown funded accounts cost prop firms more than trailing drawdown ones.

E8’s pivot to only offering trailing drawdown is an understandable decision to reduce risk, and like Andrew says it lets them operate with fewer rules. Many firms that offered unsustainable 2-step challenges have failed, causing lots of damage. If E8 wants to make this change to reduce risk, I fully support it. But framing this move as a benevolent decision for traders, while attacking those who support 2-step challenges, seems disingenuous.

Conclusion – The Argument For 2-Step Challenges

There are established firms that have proventhe 2-step model can be sustainable. 2-Step challenges consistently offer the highest true backing per dollar of evaluation fee, and are lucrative funded accounts once passed. According to my analysis, 2-Step challenges should be of similar difficulty to pass (to 1-step), if daily drawdown is avoided. So for a serious trader with sound risk management, I believe 2-Step is the best option. And if you want the best option for the masses that ignore daily drawdown rules and blow a funded account before cashing out a single payout, the best option is simply not to trade.