Alpha Capital is a forex prop firm that has paid out over $100m to more than 100k funded traders.

But with 6 different challenges and lots of important rules, it’s hard to compare the firm to competition. There’s even some challenges that you should never choose with this firm. So in this Alpha Capital review and guide I’ll explain all the challenge details, drawdown types and hidden rules you need to know so you can decide if it’s the prop firm for you.

Alpha Capital: The Prop Journalist's Verdict

Alpha Capital is a reputable prop firm that pays out. Despite offering a large array of challenges, only the Alpha Pro 10% and Alpha Swing provide good value. Punishment for breaches of the max risk rule is unnecessarily severe and the trading dashboard leaves lots of room for improvement. Overall, with discounts the Pro 10% becomes a very competitive option, provided you have a solid understanding of the firm's rules.

Pros

- Solid reputation: Over 4.7 star rating on TrustPilot across over 17k reviews

- Great trading conditions

- Alpha Pro 10% and Alpha Swing are competitive when discounted

- Balance based daily drawdown on Alpha Pro 8%, 10% and Alpha Swing

Cons

- Hidden Maximum Lot Exposure Rule: Executing trades over the max lot exposure results in deductions of the performance fee, then account breach on the second violation

- On demand payouts require 40% best day rule

- First biweekly payout requires 5 trading days with a consistent strategy

- Payout Reliability9

- Challenge Rules7

- Trading Conditions9

- Value for Money8

- Platform & Ecosystem6

Alpha Capital was founded in 2021, then released its first challenge in 2022. It is based in the United Kingdom, created by founders George Kohler and Andrew Blaylock. The firm has 15k ratings on TrustPilot, with a 4.7 TrustScore.

Now let’s break down and compare the firm’s challenges.

Alpha Capital Challenges

Alpha Capital Group offers 6 different challenges.

- Alpha One: A 1-Step challenge featuring a 10% profit target, 6% trailing maximum drawdown, and 4% daily drawdown. While it offers a higher than average daily drawdown for a single-phase model, it is largely outclassed by competitors offering static max drawdown for a slightly higher price

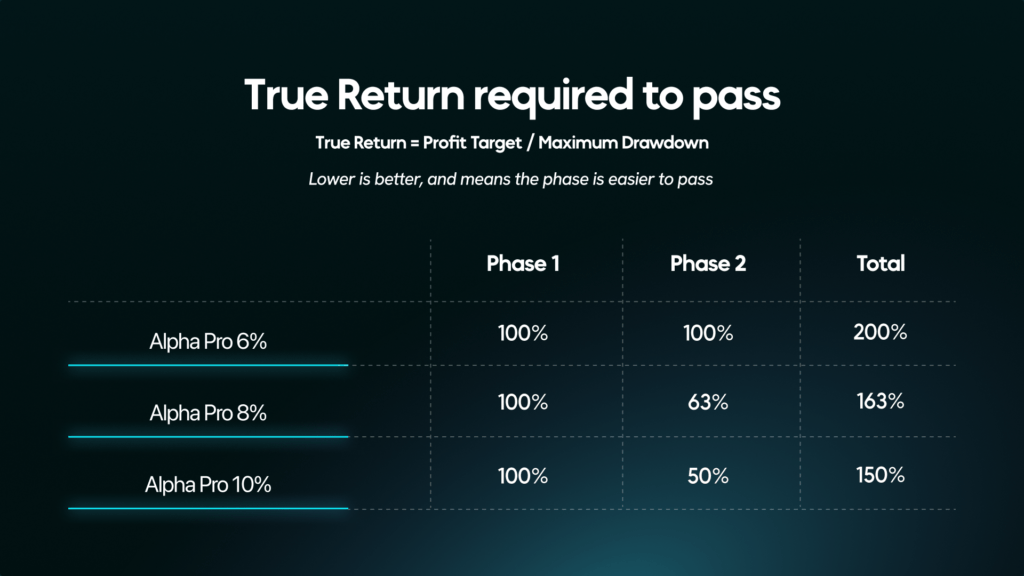

- Alpha Pro 6%: A low-value 2-Step challenge with 6% static maximum drawdown and a restrictive 3% balance and equity-based daily drawdown. Since the profit targets are also 6%, it requires a 100% true return to pass each phase.

- Alpha Pro 8%: A 2-Step challenge with 8% static maximum drawdown, 4% balance-based daily drawdown, and profit targets of 8% and 4%. Despite being harder to pass and offering less drawdown than the 10% version, it is priced higher, resulting in a poor value score.

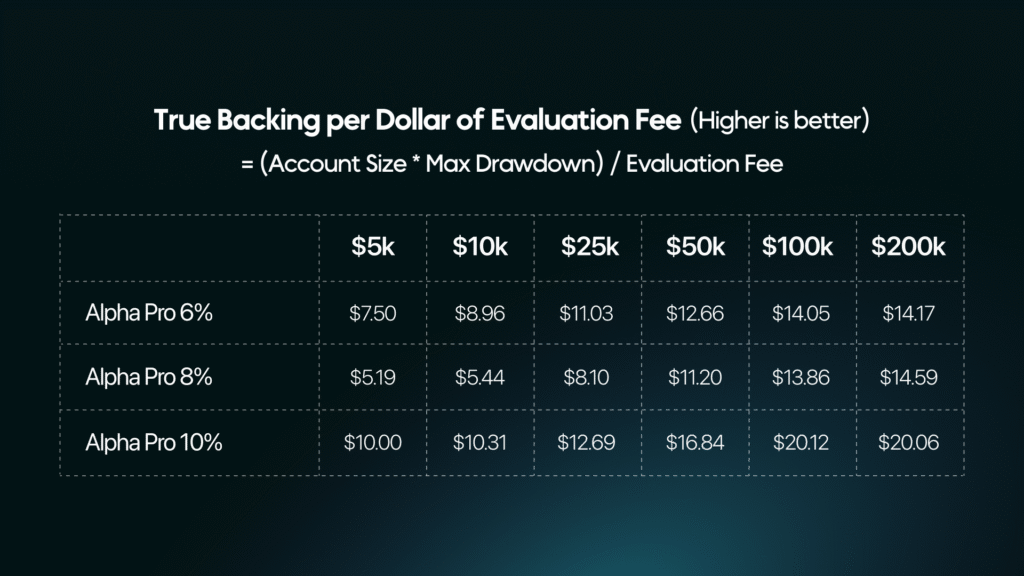

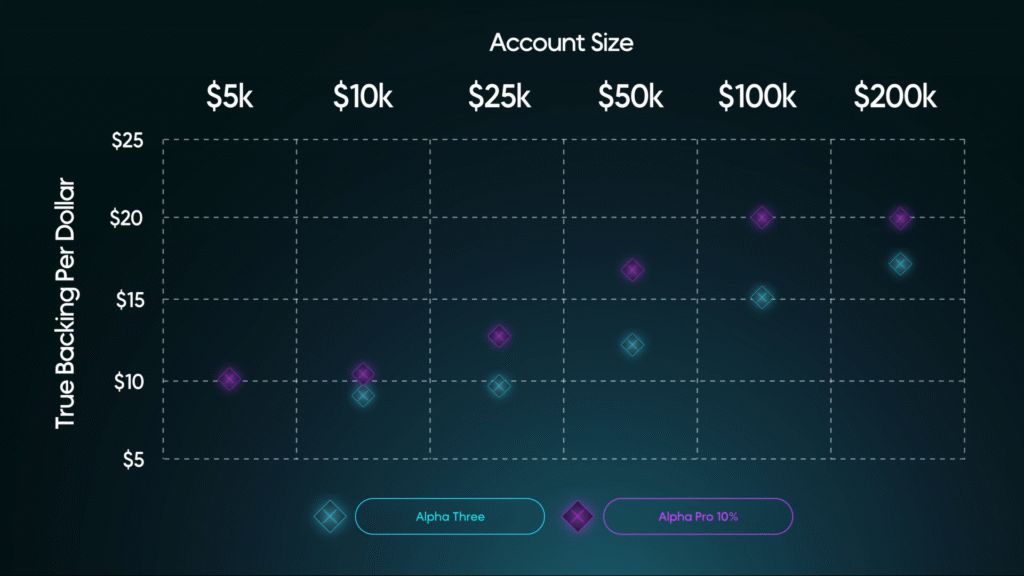

- Alpha Pro 10%: Alpha Capital’s strongest offering, featuring a 10% static maximum drawdown and 5% balance-based daily drawdown. With profit targets of 10% and 5%, it provides the best value scores and the highest amount of ‘true backing’ for the evaluation fee.

- Alpha Swing: A 2-Step account tailored for long-term traders, mirroring the 10%/5% profit targets and 10% static drawdown of the Pro 10% model. Its primary advantage is permitting weekend holding on funded accounts, though this is offset by a higher entry price, lower leverage (1:30), and lower lot size limits.

- Alpha Three: A 3-Step challenge with a 6% static maximum drawdown and 4% daily drawdown. This is the firm’s least trader-friendly model, requiring a massive 266% true return across three phases (8%, 4%, and 4% targets) to reach funding.

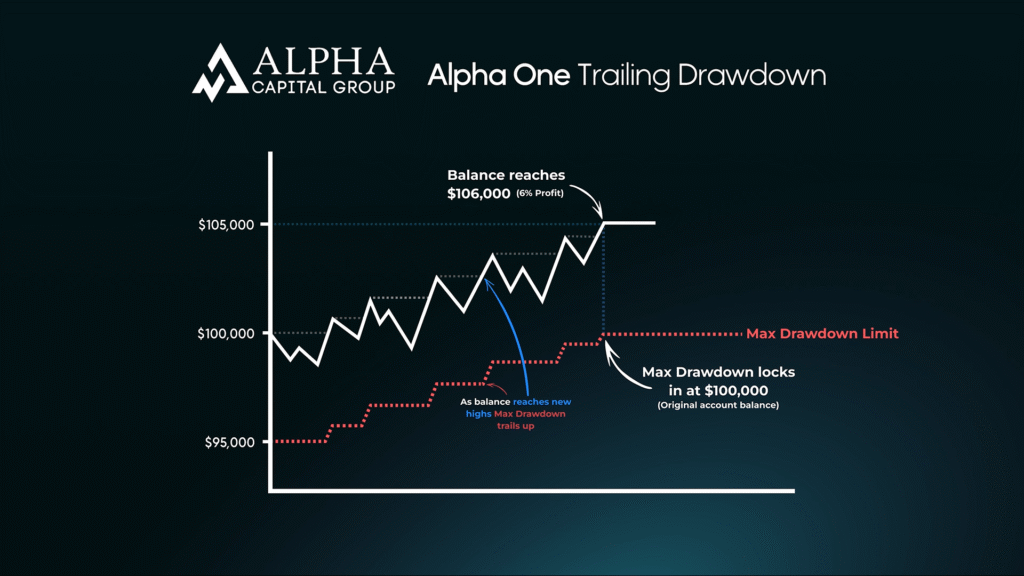

The Alpha One challenge has a single profit target of 10%, with 6% trailing maximum drawdown and 4% daily drawdown. The trailing drawdown is balance based, and becomes locked at the original account balance once 6% profit is reached.

Priced from, $50 to $997, the Alpha one is largely outclassed by other 1-Step competition.

For a slightly higher price, both FundingPips and FundedNext offer 1-Step challenges with similar parameters but the advantage of static maximum drawdown.

Meanwhile the FTMO 1-Step offers larger 10% trailing maximum drawdown, and has the advantage of resetting maximum drawdown with each payout.

The one advantage the Alpha One has is 4% daily drawdown, which is larger than the industry average of 3% for 1-Step challenges. However, this daily drawdown is equity and balance based. Also, the 6% trailing maximum drawdown makes it difficult to take advantage of the extended daily drawdown.

Once funded, payouts are on-demand but require a 40% best day score.

Overall, the Alpha One is held back by its maximum drawdown. If you want a 1-Step challenge, there’s better alternatives that are worth paying a little extra for. If you don’t mind about multiple phases, there’s many 2-Step challenges that offer double the value score of this challenge.

The Alpha Pro 6% has profit targets of 6% in both phases, 6% static maximum drawdown and 3% daily drawdown, which is balance and equity based. Priced from $40 to $847, it is the cheapest Alpha Pro challenge, but don’t be fooled by the lower prices – this challenge is bad value for money.

Its key issue is the low 6% maximum drawdown. This causes two key issues. Firstly, it means 40% lower true backing than a challenge with 10% maximum drawdown. Second, it makes the 6% profit targets harder to achieve.

Passing a phase with a 6% profit target and 6% maximum drawdown requires an 100% true return. This means each phase is the equivalent of requiring a 10% profit target in a challenge with 10% maximum drawdown. Compare this to the standard 2-Step targets of 10% then 5%, and you can easily see how the Pro 6% is more difficult to pass.

Not only this but the challenge has 3% balance and equity based daily drawdown, which is very low compared to the industry average of 5% for 2-Steps. Despite sharing the same name, the Alpha Pro 8% and 10% have the advantage of balance based daily drawdown compared the the 6%.

Like the FundingPips 2-Step Pro, the Alpha Pro 6% is a low maximum drawdown challenge that would require a significantly cheaper evaluation fee to be viable. The Pro 8% suffers from a similar issue, while the Pro 10% is the best out of the three.

It Alpha Pro 8% has 8% and 5% profit targets, with 8% static maximum drawdown and 4% daily drawdown, which is balance based.

The Pro 8% is an unusually priced challenge. It is slightly harder to pass and offers lower true backing than the Pro 10% because of its 8% maximum drawdown. Most other parameters like drawdown type are the same between the two. Yet the Alpha Pro 8% has a higher evaluation fee, significantly so in lower account sizes.

This results in much lower true backing per dollar of evaluation fee, which when paired with a slightly harder challenge results in a significantly lower value score than the Pro 10%.

Even if these were challenges with different firms, it would be difficult to argue that a firms perks and benefits could justify this difference in value. And since they are both offered by Alpha Capital, the Pro 10% is the best choice with no discussion.

The Alpha Pro 10% is cheaper than the Pro 8% but more expensive than the Pro 6%. It has profit targets of 10% and 5%, with 10% static maximum drawdown and 5% daily drawdown which is balance based.

This is the best challenge Alpha Capital currently offers. With 10% maximum drawdown it offers large true backing, with reasonable profit targets. And with a $497 base price for $100k accounts, and frequent discounts, it quickly becomes a very competitive 2-step challenge.

The only key disadvantage is its payout options. It offers either on-demand or biweekly payouts. However, on-demand payouts require a 40% best day rule, and biweekly require 5 trading days with a consistent strategy for the first payout. These are not significant restrictions, but do slow down getting paid once you’re funded.

The Swing challenge has the same parameters as the Alpha Pro 10% and has the benefit of allowing weekend holding on the funded account. But it has lower leverage, has lower max lot rule limits and costs more.

On the funded account, it only offers on-demand payouts. If you want to hold trades over the weekend with Alpha Capital, this is the challenge for you, because it has static maximum drawdown compared to the Alpha One challenge, and is easier to pass than the Alpha Three challenge.

The Alpha Three Challenge costs from $67 to $697. It has profit targets of 8%, 4% and 4%. It has 6% static maximum drawdown and 4% daily drawdown, which is equity and balance based.

Each phase requires 3 minimum trading days. The funded Three Account offers Bi-weekly or on-demand payouts.

This challenge is terrible. It requires a ridiculous 266% true return to pass. And it provides worse true backing per dollar of evaluation fee than the Alpha Pro 10%.

3-Step challenges are almost never worth the extra difficulty of passing, and this one definitely isn’t. You are essentially paying for a challenge that is twice as hard to pass, while getting significantly worse value for money. This challenge is so bad that trading the evaluation fee on a personal account would actually be more profitable for some account sizes.

Drawdown Rules

All Alpha Capital accounts apart from the Alpha One have static maximum drawdown. The Alpha One, Pro 6% and Three have equity and balance based daily drawdown. The Alpha Pro 8% and 10%, and the Alpha Swing have balance based daily drawdown.

Maximum Drawdown

Maximum drawdown is calculated based on the initial account balance. E.g. 10% maximum drawdown on an $100k account is $10k, meaning the drawdown limit is placed at $90k.

This drawdown limit will either remain locked in place with static maximum drawdown, or move upwards with trailing.

Static

The Alpha Pro 6%, 8% and 10%, Alpha Swing and Alpha Three accounts all use static maximum drawdown.

Static maximum drawdown does not move.

Trailing

The Alpha One account uses balance based intraday trailing maximum drawdown.

This drawdown trails up with new balance highs. Once it reaches the original account balance the drawdown locks in place.

Daily Drawdown

Daily drawdown is calculated as a percentage of initial account balance. E.g. 5% daily drawdown on an $100k account is a $5k.

The daily drawdown reset takes place at midnight Platform Time, which is GMT+2.

Equity and Balance Based

The Alpha One, Pro 6% and Three have equity and balance based daily drawdown.

This daily drawdown is calculated using equity or balance, whichever is higher.

Balance Based

The Alpha Pro 8% and 10%, and the Alpha Swing have balance based daily drawdown.

This daily drawdown is calculated using using only balance. It is more favourable than equity and balance based daily DD.

Alpha Capital Payouts

Alpha Capital Group offers payouts through Rise, Wise and Bank Transfer. Reward splits are always 80% of the profit earned on the account. Payout frequency is either on-demand, or biweekly.

To request on-demand payouts, you must follow the 40% best day rule and have a minimum 2% profit. The 40% best day rule states that no single trading day should contribute more than 40% of the total generated profits.

For bi-weekly payouts, the minimum withdrawal amount is $100. Also, for the first biweekly payout request a minimum of 5 trading days using the same strategy is required.

With both withdrawal frequencies, on the fourth performance fee request a discretionary bonus of 0.25% of the initial account size is applied.

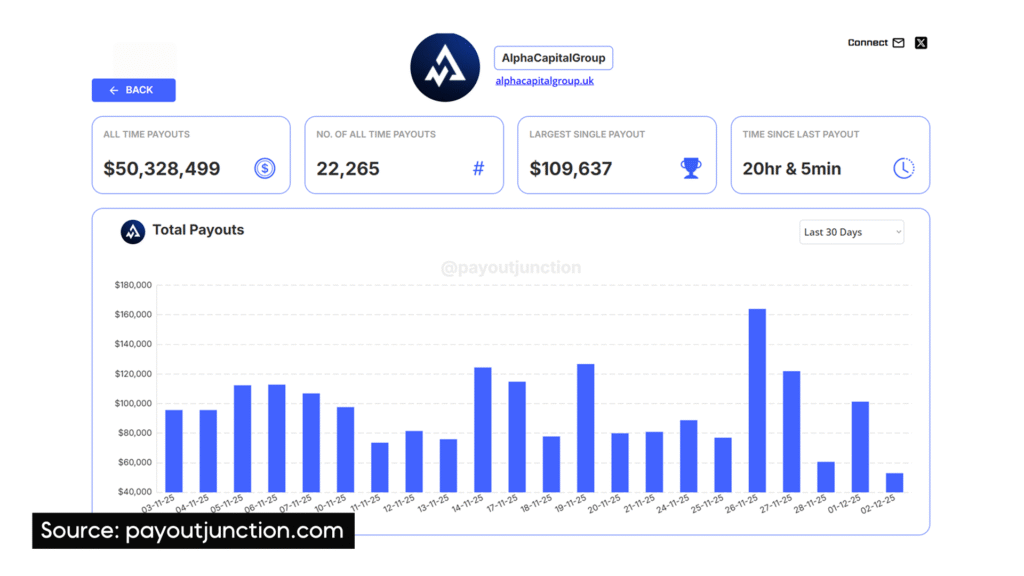

Alpha Capital has paid out over $100m to traders. Over $55m of which can be verified on the Rise blockchain. In the past 30 days the firm sent over $2.5m in payouts via Rise.

Trading Platforms & Conditions

Alpha Capital Group offers MetaTrader, cTrader, DXTrade and Tradelocker as trading platforms. However, US residents may not use MetaTrader.

The firm uses ACG Markets as a broker, which is FSA Regulated.

Spreads & Commissions

When purchasing your account, you must choose between standard and raw spreads. Standard accounts have larger spreads but no commissions. Raw accounts offer tight spreads from 0.1 pips, but $5 commission per lot round trip. Indices are commission free on both account types.

Leverage

Leverage is up to 1:100 on Alpha Pro, 1:50 on Alpha Three, and 1:30 on Alpha Swing and Alpha One.

| Instrument | Alpha Pro | Alpha Swing / Alpha One | Alpha Three |

| Forex | 1:100 | 1:30 | 1:50 |

| Indicies | 1:20 | 1:10 | 1:10 |

| Metals | 1:30 | 1:9 | 1:9 |

| Oil | 1:10 | 1:10 | 1:10 |

Trading Restrictions

Weekend holding and news trading restrictions depend on Alpha account type. Also, you should be aware of the max lot size rule that limits combined opened position size on the funded account.

Weekend Holding

For the Swing, One and Three plans, holding trades over the weekend is allowed in all stages. For Pro plans, holding trades over the weekend is allowed during the evaluation, but not on the funded account.

Holding trades over the weekend on the Pro funded account is only a soft breach, meaning profits from trades are removed but the account remains active.

News Trading

Trading news during the evaluation phase is allowed on all accounts, but is limited by the gambling rule.

On funded accounts restrictions apply. The Alpha Pro 8% and 10% funded accounts have a 4 minute restricted window around high impact news.

The Alpha Pro 6%, Alpha One and Alpha Three funded accounts have a 10 minute restricted window.

If a trade is opened or closed within this window, profits made will be deducted from the account. News trading is allowed on the Alpha Swing funded account, but if a trade is initiated within the 4 minute window around a high impact news release, its duration must exceed 2 minutes for the trade to be valid.

The gambling rule also restricts news trading, prohibiting trades initiated just before and closed right after the restricted high-impact news trading window on the Pro/One/Three models. Generally short-term trades on the Swing account model, that identified as solely speculative around high-impact news, are prohibited too.

Max Lot Size Rule

There are no maximum lot size limits during evaluations. However, on funded account lot exposure limits apply.

Max lot exposure is the total combined allowed lots/position size allowed at any one time on the account.

On the first instance of violating this rule, the performance fee acquired through lot sizes exceeding the limit will not be eligible for withdrawal. On the second instance the performance fee will be forfeited and the account will be deactivated.

| Account Size | Alpha One, Alpha Pro, Alpha Three | Alpha Swing |

| $5k | Max 2.5 lots | Max 1.25 lots |

| $10k | Max 5 lots | Max 2.5 lots |

| $25k | Max 10 lots | Max 5 lots |

| $50k | Max 20 lots | Max 10 lots |

| $100k | Max 40 lots | Max 20 lots |

| $200k | Max 80 lots | Max 40 lots |

| $300k | Max 120 lots | Max 60 lots |

This rule is dangerous for traders given the strict consequences of breaking it, but the limits are large enough that they can be avoided without issue. It’s worth double checking your limits when taking multiple trades simultaneously on the funded account so you’re not caught out.

Prohibited Strategies

Prohibited trading strategies include:

- Group trading/signal following

- Taking advantage of unrealistic prices or unrealistic trade opportunities, such as arbitrage, latency, front-running price feeds, and exploiting mispricing.

- Latency trading

- Arbitrage trading

- High-frequency trading

- Reverse trading/group hedging

- Spamming Order Book

- Account management services are not allowed, and all accounts and trades must be performed by the trader whose name is on the account.

Additional Rules

- Inactivity: Make sure to take a trade once every 30 days to avoid breaching the inactivity rule.

- IPs and VPNs: Trading with multiple IP addresses and devices, and using VPNs is allowed, provided that the trades are only being executed by the individual who is the account holder.

- Copy trading is allowed, but proof of ownership of the master account is required. EA trading is allowed, but is only possible on Metatrader.

- EAs must be approved before use, by sending the source code to the firm.

- Gambling rule: Trading strategies that are deemed “all or nothing” are prohibited. This includes high lot size and trade length variation.

Allocation & Scaling

Alpha Capital Group offers an initial maximum allocation of $400k, with a $300k limit per strategy. This can be increased up to $2m with scaling.

Scaling is available on Alpha Pro, Swing and Three accounts.

Scaling is achieved when a 10% gain is achieved, and requested in a single payout. When this happens the reward split is paid out, and the account is increased by 10% of the initial account balance.

On the scaled up account a minimum of 5 trading days is required before requesting another reward split. On the second scale up, a max lot size increase of 10% is applied too.

Alpha Capital Review Conclusion

In conclusion, Alpha Capital Group is a reputable prop firm that pays out, but not all its challenges are worth taking. Don’t bother with the Alpha One or Alpha Three. The Alpha Pro 10% is the best pick, and the Swing account is a good option if you want to hold trades over the weekend. You can often get good value for money when Alpha Capital runs large discounts, so keep your eye out for that.

Thanks for reading, if you enjoyed check out my YouTube Channel and read more Prop Firm Reviews here.

MetaTrader 5

MetaTrader 5 cTrader

cTrader TradeLocker

TradeLocker DXTrade

DXTrade Google Pay

Google Pay Apple Pay

Apple Pay PayPal

PayPal Wise

Wise