FundingPips is a forex prop firm that offers funding up to $2m to traders worldwide. So far, the company has paid out over $200m.

In this FundingPips review and guide I’ll break down everything you need to know: the rules, account details, tools, and trading conditions. I’ll also share proof of my own payouts and earnings from the wider community, so you can decide whether FundingPips is the right prop firm for you.

Funding Pips: The Prop Journalist's Verdict

Funding Pips is a well established prop firm that has fair challenges and pays out. Its consistency rules may be an issue, but are avoidable by choosing alternative reward cycles on all challenges apart from the zero account.

Pros

- Reliable Payout History: Over $200M paid out and verifiable on-chain.

- Static Drawdown: Available on the 1-Step and 2-Step regular challenges.

- Competitive Pricing: The regular 2-Step offers high true backing for its price

- Flexible Reward Cycles: Options for on-demand, weekly, biweekly and monthly payouts

Cons

- Strict Zero Account Rules: Trailing drawdown and high consistency requirements.

- Potential Slippage: Some reports of slippage, which may affect high-frequency scalpers.

- Max Loss Per Trade Rule: A strict breach condition on funded accounts.

- Payout Reliability9

- Challenge Rules8

- Trading Conditions7

- Value for Money9

- Platform & Ecosystem10

Founded in 2022 by Khaled Ayesh, Funding Pips has rapidly scaled to become a dominant force in the prop industry. Headquartered in Dubai, the firm has distributed over $200 million in payouts that can be verified on the Rise blockchain. In the last 30 days the firm processed out over $12m in withdrawals.

With a 4.5-star Trustpilot rating across 45,000+ reviews, they are currently one of the most popular retail CFD prop firms right now.

Below we’ll dive into the specific challenge parameters and rules you need to know, and compare FundingPips directly to the competition.

FundingPips Challenges & Accounts

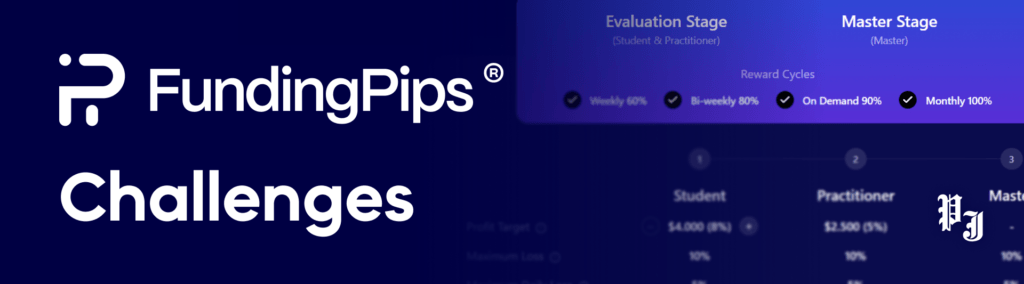

FundingPips offers 4 different accounts:

- Zero Instant Funding: Offers immediate access to capital but behaves more like a 1-Step challenge due to the 3% safety cushion rule, which means the first 3% of profits cannot be withdrawn. It is the firm’s most restrictive model, requiring a 15% consistency score to withdraw and at least 7 minimum profitable days every 30 days to keep the account active. Additionally, it features an intraday equity-based trailing drawdown, which is considered the most restrictive and difficult type of maximum loss limit in the industry.

- 1-Step Challenge: A solid single-phase offering with a 10% profit target and a 6% static maximum drawdown. While the static drawdown is a key selling point compared to competitors’ trailing models, it offers worse overall value than the 2-Step regular challenge.

- 2-Step Challenge: FundingPips’ strongest offering, featuring a 10% static drawdown paired with 8% & 5% profit targets. While priced competitively, it is significantly held back by a dangerous maximum loss per trade rule on funded accounts, which can result in an immediate account breach.

- 2-Step Pro Challenge: A low-value alternative to the regular 2-Step, featuring a tighter 6% maximum drawdown and two 6% profit targets. This setup requires a 100% true return to pass each phase and provides significantly less “true backing” per dollar spent. The regular 2-Step remains the superior choice for value and passability.

Now we’ve covered an overview of the key parameters of FundingPips’ challenges, let’s look at all the challenges and rules in depth.

The FundingPips Zero account is the firm’s instant funding offering. Priced from $69-$499, with 5% trailing maximum drawdown, it initially looks like a relatively standard account.

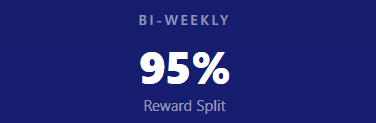

The profit split is a high 95%, which can be requested every 14 calendar days. However, like most instant funding accounts, the FundingPips Zero comes with a pile of restrictive rules that make getting a payout very difficult. These requirements are:

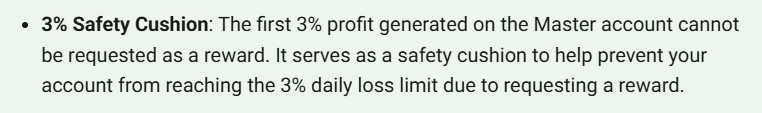

- Have a 3% Safety Cushion

- Pass 15% Consistency Score

- Your biggest loss does not exceed your biggest win

The 3% Safety Cushion rule states that the first 3% profit generated on the funded account cannot be requested as a reward. As the minimum reward amount is 1% of the initial balance, this means you need to make 4% profit before requesting a payout.

This rule essentially turns the Zero account into a 1-Step challenge. The first consists of 5% drawdown and the 3% profit target which you can’t withdraw. Once you pass this ‘stage’, you’re still on the same account but can actually withdraw profits past this point. But there’s more rules to consider if you’d actually like to do so.

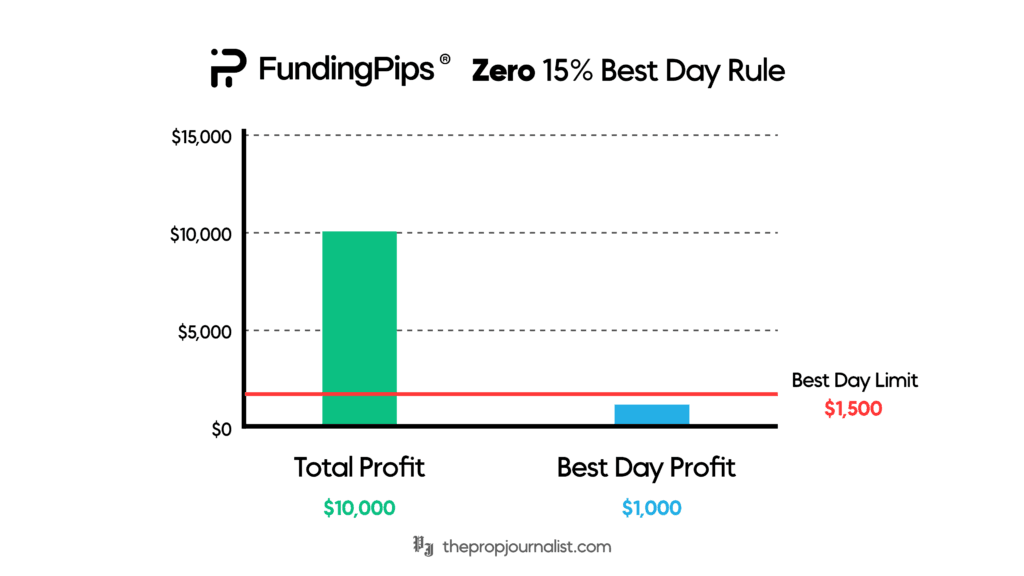

For the consistency rule, you must achieve a 15% consistency score and have at least 7 profitable days, where a day is counted as profitable if the profit is at least 0.25% of the initial account size. The consistency score is the size of your biggest win in comparison to your current total account profit.

So the maximum profit you can earn in one day is 15% of your total profit. In other words, your consistency score must be 15% or below. This means that while 7 profitable days is the minimum needed to request a payout, it will likely take you more profitable days before you satisfy the consistency rule.

Finally, to request a payout your biggest loss must not exceed your biggest win. This means trading strategies with risk to reward ratios less than 1 won’t be suitable for the Zero account.

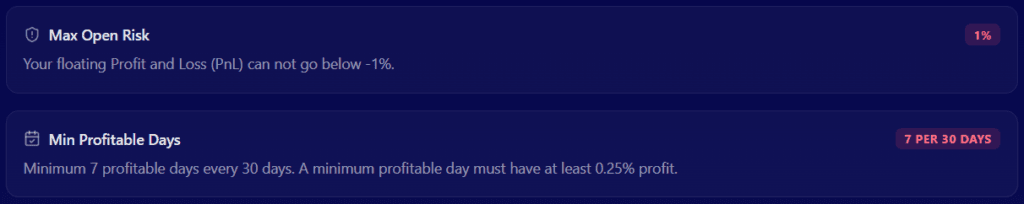

Another key rule is that you must have at least 7 minimum profitable days over each 30 day period, with the first period starting on the day you take your first trade. If you fail to do so, you will lose the account. Also the 1% Maximum Risk Limit means your floating profit and loss must not exceed 1% of the account size.

The combination of all these rules means that the FundingPips zero account is only suitable for trading strategies that take trades almost every day, and have very similar profit targets that are more than 1R for each trade. Otherwise violating the minimum profitable days rule becomes a risk, and reaching the consistency rule will take a long time. Not to mention the intraday equity-based trailing drawdown is the worst type of max drawdown in the industry.

As a result, this account has been given the worst TPJ rating possible of D. Instant accounts are generally not attractive offerings, but even within this category FundingPips falls behind.

The FundingPips 1-Step Challenge has a 10% profit target, with 6% static maximum drawdown and 3% daily drawdown. While this daily drawdown is balance and equity based, the static max drawdown is a key selling point compared to most other 1-Step challenges that have trailing.

Once you reach the funded account, you must choose your Reward Cycle frequency, which affects the reward split and rules for the account.

| Reward Frequency | Reward Split | Minimum Withdrawal | Other Requirements |

| On Demand | 90% | 2% | 35% Consistency Score |

| Weekly | 60% | 1% | None |

| Biweekly | 80% | 1% | None |

| Monthly | 100% | 1% | None |

On demand rewards is the final option, offering a 90% reward split, but requiring a 35% consistency score, and a minimum reward amount of 2% of the initial account balance. Meanwhile the other withdrawal frequencies have no consistency rules and have a minimum reward amount of 1% of the initial account balance.

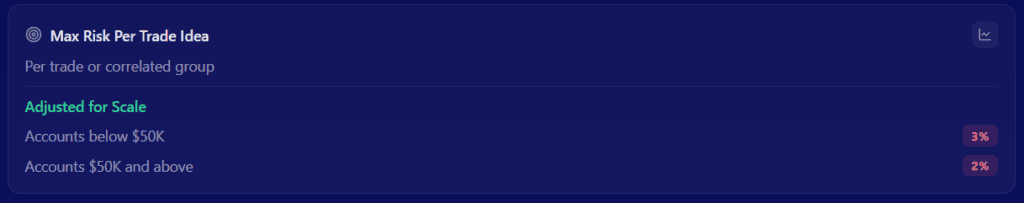

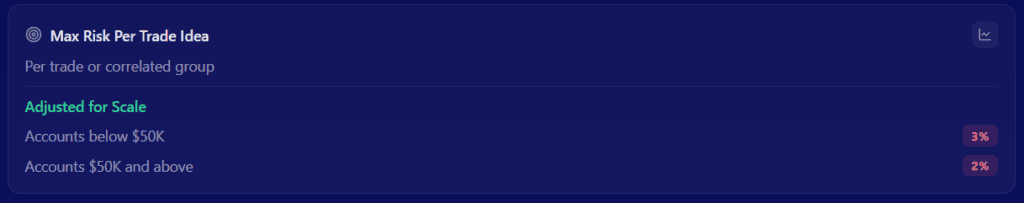

The funded master account also has a maximum loss per trade rule of 3% for accounts below $50k, and 2% for accounts $50k and above. If this is breached, the account is lost. Be aware that this includes splitting a trade into multiple positions, and opening a new position in the same direction within 10 minutes after closing a losing trade. This maximum loss per trade rule does not apply during the challenge stage.

The FundingPips 1-Step is solid for a single phase challenge. The FundedNext Stellar 1-Step is very similar, having the advantage of balance based daily drawdown, but costs more than FundingPips. The FTMO 1-Step is also solid competition with large 10% maximum drawdown, but this drawdown is trailing and the FTMO evaluation fee is a premium price.

The FundingPips 1-Step is ultimately limited by its low 6% maximum drawdown, which reduces its value compared to the more affordable 2-Step challenge.

The FundingPips 2-Step is the firm’s best offering by far. With profit targets of 8% and 5%, 10% static maximum drawdown and reasonable prices, this challenge has high value scores, especially on large account sizes. However, the challenge is held back by a restrictive and dangerous maximum risk.

The max risk per trade rule is only active on the funded account. It 3% limits for accounts below $50k and 2% limits for accounts $50k and above.

Because the 2-Step has larger drawdown parameters, particularly the 5% daily drawdown, traders can easily slip up and breach the max risk rule if they’re not careful.

Taking another trade in the same direction within 10 minutes after closing a losing trade is considered part of the same trade idea too.

The dangerous part about this rule is that if it’s breached, your account is lost. On large account sizes, this means risking 1.5% or more per trade is extremely risky, as slippage could easily result in losing the account.

The redeeming factor is that this rule is only present on the funded account. Risking 1% or below once funded is standard practice, and should keep you safe from any max risk breaches.

The funded account offers On Demand to Monthly withdrawals, which impact the reward split you receive.

| Reward Frequency | Reward Split | Minimum Withdrawal | Consistency Rule |

| On Demand | 90% | 2% | 35% Best Day |

| Weekly | 60% | 1% | None |

| Biweekly | 80% | 1% | None |

| Monthly | 100% | 1% | None |

Overall, if you’re conservative and can avoid the max risk rule, the FundingPips 2-Step is a solid option. However, if you’re want to take higher risk on the funded account, several competitors like FundedNext offer similar 2-Step challenges worth exploring.

The FundingPips 2-Step Pro has two profit targets of 6%, with 6% static maximum drawdown and 3% daily drawdown.

| Reward Frequency | Reward Split | Minimum Withdrawal | Consistency Rule |

| Daily | 80% | 1% | 35% Best Day (only during challenge) |

| Weekly | 80% | 1% | None |

On the funded account, you have the option between weekly payouts with an 80% reward split, or daily payouts with the same split but also a 35% consistency requirement.

Regular vs Pro 2-Step

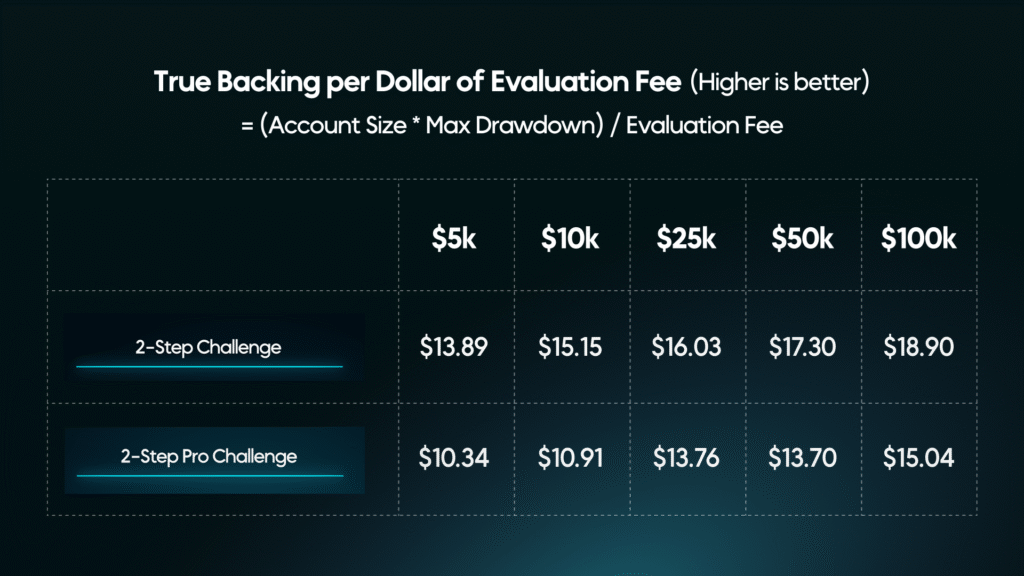

The 2-Step Pro challenge is cheaper than the 2-Step regular, but the regular challenge is significantly better. So much so that I’d argue there’s no reason anyone should choose the Pro over the regular 2-step.

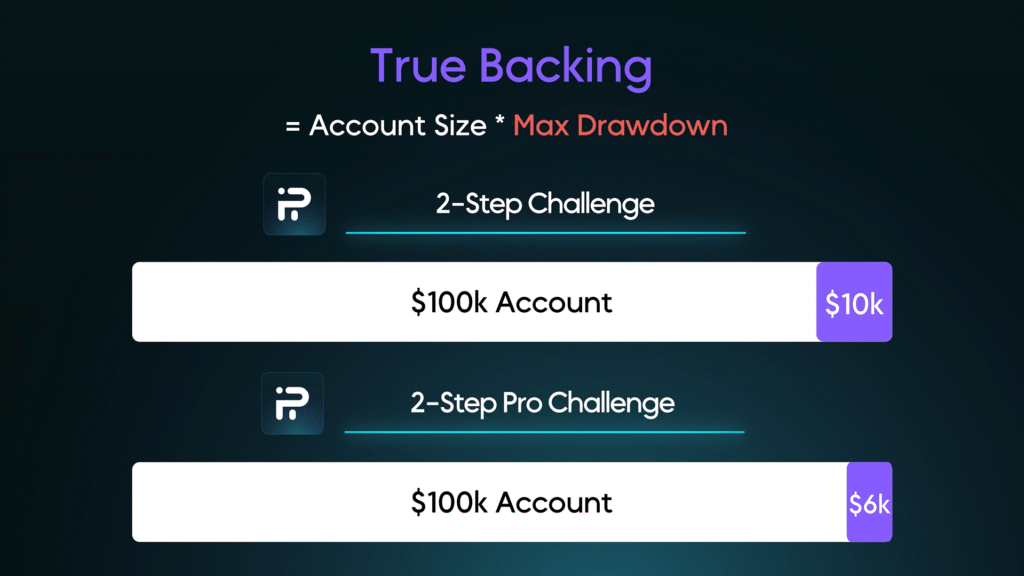

This is because the pro has a lower 6% maximum drawdown. Max drawdown is one of the most important parameters for a prop firm. It determines the true backing, which is the maximum amount of money a trader can lose before they lose their account. For example, an 100k funded trader doesn’t really have 100k in backing, they only have $10k to work with if maximum drawdown is 10%.

This is the case with the FundingPips regular 2-step. Meanwhile the 2-Step Pro has 6% max drawdown, meaning $6k true backing on an $100k account. So if we compare the true backing per dollar of evaluation fee, the 2-step regular is actually better value, despite the higher price.

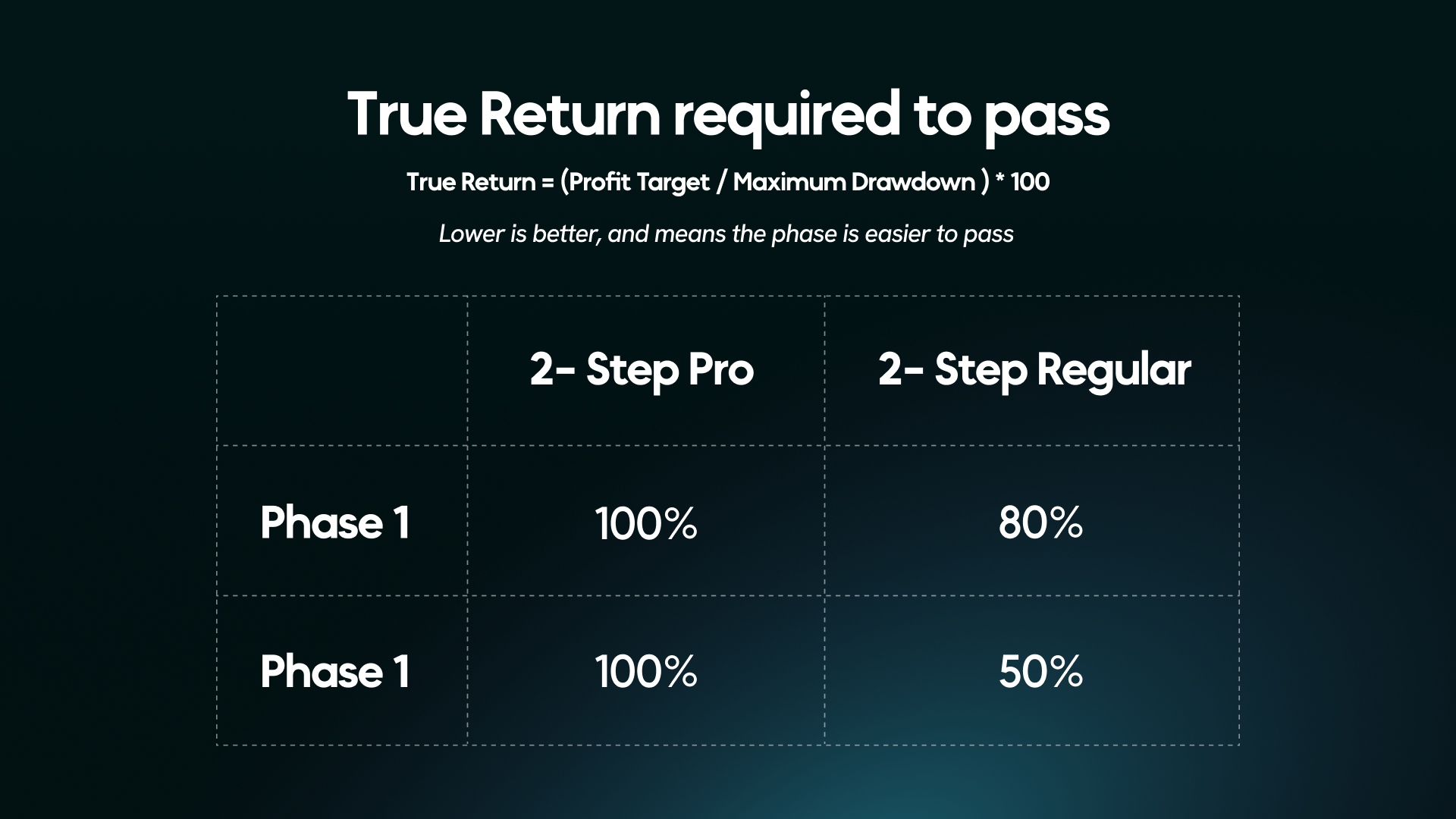

That’s not all. Lower maximum drawdown also makes the pro challenge harder to pass. Each phase has 6% maximum drawdown and a 6% profit target, which is a drawdown to profit target ratio of 1:1. Meaning each phase requires a 100% true return to pass. Meanwhile the regular 2-step has ratios of 1:0.8 and 1:0.5, meaning 80% and 50% true returns to pass.

All this means that the pro challenge is both harder to pass, and worse value for money than the regular 2-step. The only benefits it has are the lower minimum trading days, and the option for weekly 80% reward split withdrawals, compared to the regular bi-weekly 80% reward split withdrawals. These are negligible benefits, and definitely don’t make up for the Pro challenge’s disadvantage.

So why does this challenge even exist? It’s because the lower phase 1 profit target, and cheaper price look attractive to traders that don’t consider the lower maximum drawdown. But now I have explained the disadvantages, you won’t get caught out by challenges like this.

Drawdown Rules

FundingPips offers both static and trailing maximum drawdown. All accounts have balance & equity based daily drawdown rules.

Maximum Drawdown

Maximum drawdown is calculated based on the initial account balance. E.g. 10% maximum drawdown on an $100k account is $10k, meaning the drawdown limit is placed at $90k.

This drawdown limit will either remain locked in place with static maximum drawdown, or move upwards with trailing.

Static

The FundingPips 1-Step, 2-Step and 2-Step Pro all use static maximum drawdown.

Static maximum drawdown does not move.

Trailing

The FundingPips Zero account uses equity based intraday trailing maximum drawdown.

This drawdown trails up with new equity highs. Once it reaches the original account balance the drawdown locks in place.

Daily Drawdown

All FundingPips accounts have a balance & equity based drawdown. This is calculated as a percentage of initial account balance. E.g. 5% daily drawdown on an $100k account is a $5k.

The daily drawdown reset takes place at midnight Platform Time, which is GMT+2. At this point daily drawdown is calculated using either equity and balance, whichever is higher.

Equity cannot fall lower than the daily drawdown limit for the next 24 hours, or the account is breached. Then the next platform day starts, daily drawdown is recalculated, and the cycle continues.

At any point your maximum daily loss is easily shown on the FundingPips dashboard, with a countdown timer until it resets.

FundingPips Payouts

FundingPips offers payouts through Rise, Cryptocurrency and bank transfer.

The firm offers payouts on-demand, daily, weekly, biweekly and monthly.

Once you reach the funded account, you must choose a reward cycle frequency. This determines the reward split, and once chosen it cannot be changed.

| Reward Frequency | Zero | 1-Step | 2-Step | 2-Step Pro |

| On-demand | — | 90% | 90% | — |

| Daily | — | 60% | 60% | 80% |

| Weekly | — | — | — | 80% |

| Biweekly | 95% | 80% | 80% | — |

| Monthly | — | 100% | 100% | — |

Requesting a payout is a simple process through the dashboard. I received my payout within 48 hours of requesting it, with no issues.

The firm has paid out over $200m to traders, with payments being verifiable on the Rise blockchain. In the past 30 days, FundingPips paid out over $10 million.

Trading Platforms & Conditions

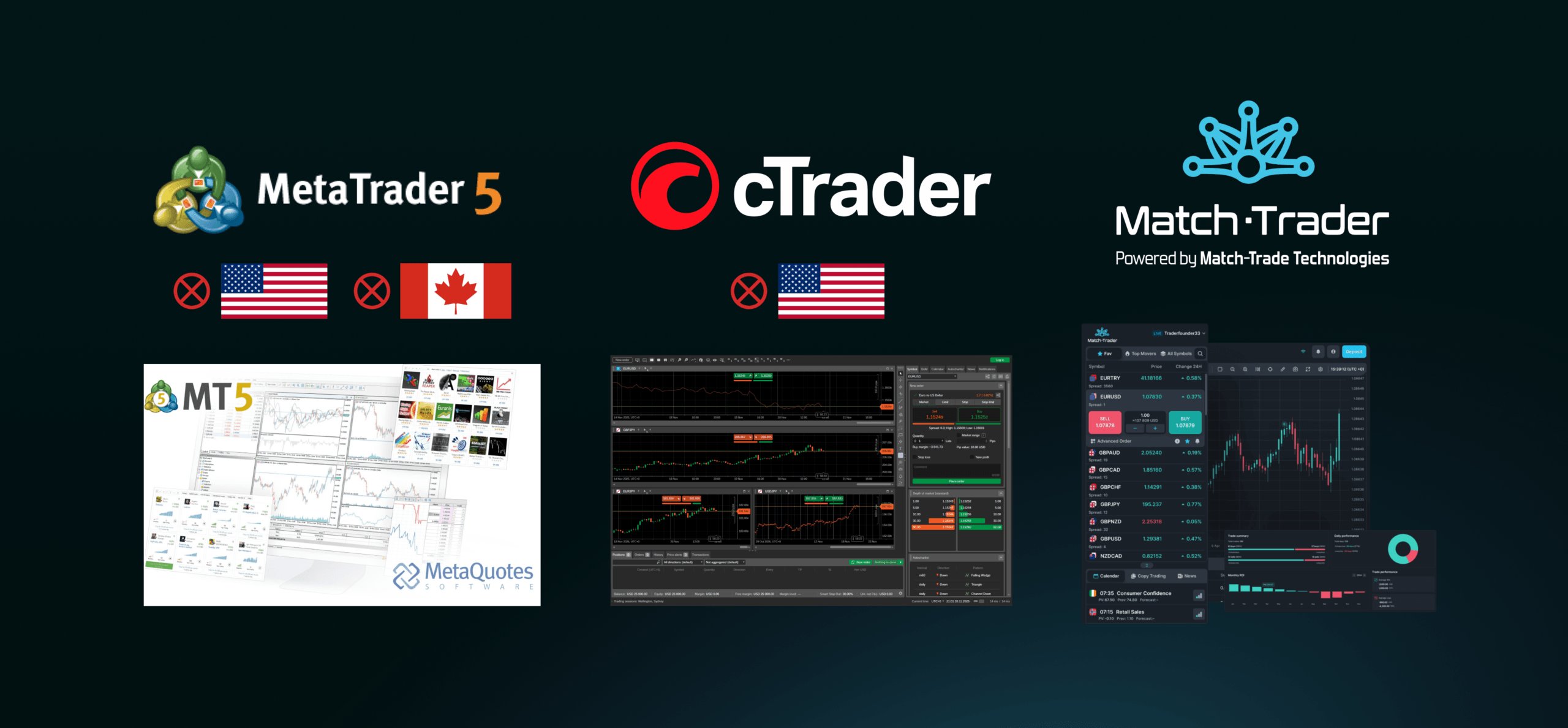

FundingPips offers 3 trading platforms: Metatrader, cTrader and Match Trader.

However, US residents can’t use Metatrader or cTrader, and Canadian residents can’t use Metatrader. Also, choosing cTrader adds $20 to the evaluation fee, while MetaTrader and Match Trader are free.

Spreads & Commissions

The firm offers raw spreads from 0 pips.

- Forex and metals charge:

- $7 per lot round trip on the Zero account

- $5 per lot round trip on the 1-Step, 2-Step and 2-Step Pro accounts

- $10 per lot round trip on swap free accounts

- Energies and indices are commission free

- Crypto commissions are 0.04%

| Instrument | Zero | 1-Step / 2-Step / 2-Step Pro | Swap Free Account |

| Forex | $7 per lot | $5 per lot | $10 per lot |

| Metals | $7 per lot | $5 per lot | $10 per lot |

| Energies | No commission | No commission | No commission |

| Indicies | No commission | No commission | No commission |

| Crypto | 0.04% | 0.04% | 0.04% |

Leverage

Funding Pips offers up to 1:100 leverage, depending on account and instrument type.

- 2-Step challenges offer up to 1:100 leverage

- The 1-Step offers up to 1:30

- The Zero account offers up to 1:50

- Accounts with the Swap Free add-on have up to 1:30 leverage

| Instrument | Zero | 1-Step | 2-Step / 2-Step Pro | Swap Free Account |

| Forex | 1:50 | 1:30 | 1:100 | 1:30 |

| Metals | 1:20 | 1:10 | 1:30 | 1:10 |

| Energies | 1:10 | 1:10 | 1:10 | 1:10 |

| Indicies | 1:20 | 1:5 | 1:20 | 1:5 |

| Crypto | 1:2 | 1:1 | 1:2 | 1:1 |

Swap Free Add-On

At the purchase page, all accounts have the option for the swap free add-on. This allows traders to hold trades overnight without incurring swap fees. However, this increases the evaluation fee by 10%, reduces leverage and increases commissions on forex and metals to $10 per lot round trip.

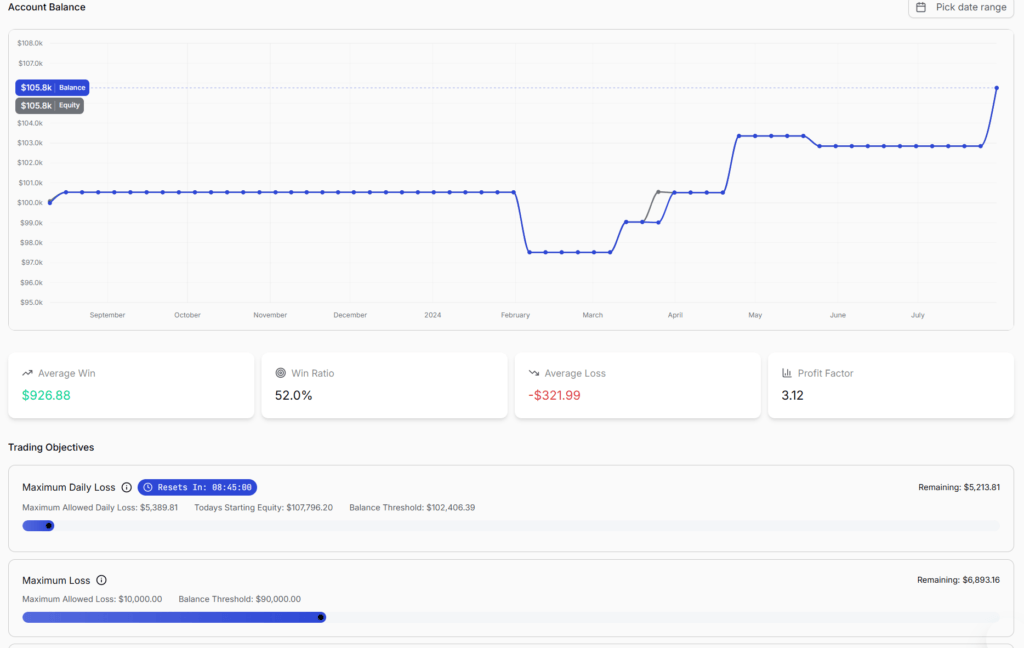

Trading Dashboard

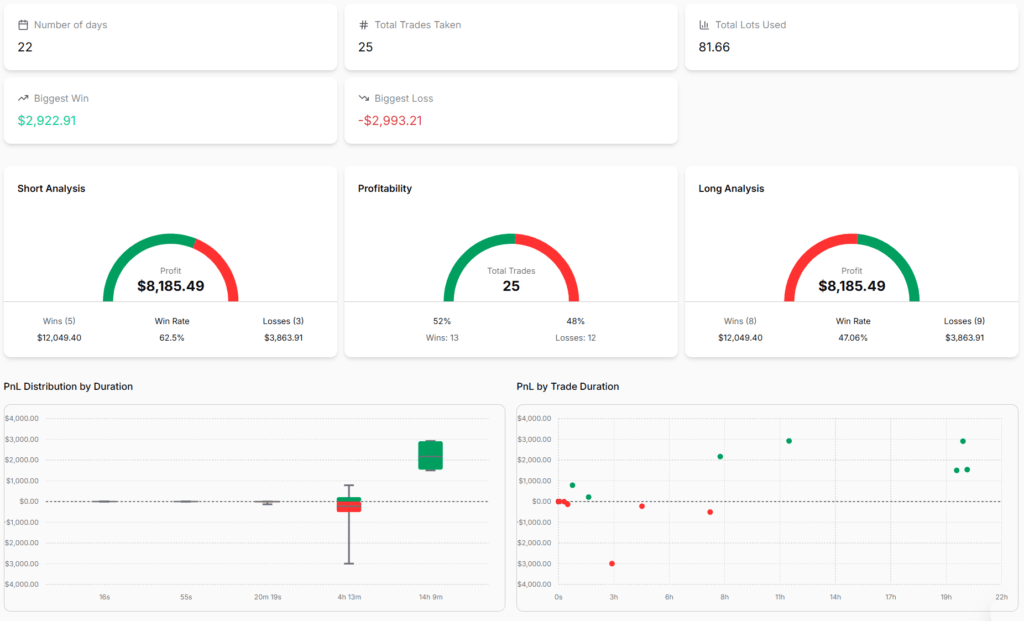

FundingPips offers a clean trading dashboard to track your trading accounts and challenge progression.

Account pages display all key trading parameters like loss limits and profit targets. Also, detailed trading statistics are displayed to help with trade journaling and analysis.

Trading Restrictions

News and weekend trading restrictions depend on the account type and selected reward cycle.

Weekend Holding

Weekend holding is allowed on all accounts apart from the Zero account. Holding trades over the weekend on the Zero account will result in an account breach.

News Trading

FundingPips uses ForexFactory as their source for news events. High impact (red) news events are considered for news trading rules.

Purposely trading news is prohibited and will lead to account closure. On challenge phases executing trades around high impact is allowed, but the strategy can’t be focussed on trading news.

News trading is restricted on all funded accounts. You cannot open or close positions within a window (see table) of high impact news. If you breach this rule, the profit from the trade will be deducted from your account. However, if the trade was opened more than 5 hours before the high impact event, the profit will not be deducted.

For high impact speeches, the window is considered from the start of the speech to the end. E.g. for a ± 10 min window around a 15 min speech starting at 1:00, trading is prohibited from 0:50 to 1:25.

Prohibited Strategies

- Any Trading activity that includes gap trading, high frequency trading, toxic trading flow, server spamming, latency arbitrage, hedging, long short arbitrage, reverse arbitrage, tick scalping, server execution, opposite account trading, and churning and burning are all prohibited trading methods.

- Copy trading or account management by a third-party vendor will result in account termination.

- Excessive Risk-Taking: utilizing excessive leverage, causing overexposure or full margin is prohibited.

Additional Rules

- EA Trading: Using Expert Advisers as trade or risk managers is allowed, all other EAs are prohibited.

- Inactivity Rule: On all accounts, you must open and close a trade at least once every 30 days, or the account will be terminated.

- IP address: You must trade your account on a consistent IP address, or you may have to provide proof of travelling.

- Trade Your Own Account: Sometimes after passing your evaluation, you may need to take an interview with the FundingPips team to prove you traded your own account. This is just to prevent fraud, and you won’t have any issues if you have not broken any rules.

- 20 Lots Per Click Rule: Traders can place a maximum order size of 20 lots per click or transaction. If the trader wants to take a trade with more than 20 lots, they must execute the order in multiple transactions (e.g. 50 lots over 20 + 20 + 10 lot trades). This rule also applies for closing trades.

Allocation & Scaling Plan

FundingPips offers an initial maximum allocation of $300k, with a scaling plan up to $2m.

10% profit and 4 payouts are required to progress each scaling stage.

| Scaling Level | Total Profit Requirement | Total Payouts Requirement | Account Size | Max Drawdown | Daily Drawdown |

| 1 | 10% | 4 | +20% | +1% | – |

| 2 | 20% | 8 | +10% | +1% | +1% |

| 3 | 30% | 12 | +10% | +1% | – |

| Hot Seat | 40% | 16 | +60% | +1% | +1% |

After 4 scale ups, you reach the Hot Seat stage. In total, your trading capital will have doubled, maximum drawdown will have increased by 4%, and daily drawdown will have increased by 2%.

Additionally, the Hot Seat stage provides on-demand 100% reward splits and a monthly bonus based on account size.

| Account Size | Monthly Hot Seat Bonus |

| $5k | $100 |

| $10k | $200 |

| $25k | $300 |

| $50k | $400 |

| $100k | $500 |

Traders on the Hot Seat program are also eligible for further capital scaling up to $2m.

FundingPips Review Conclusion

In conclusion, FundingPips is a well established prop firm that has fair challenges and pays out. The dashboard and trading experience is streamlined, and my payout was sent quickly with no issues.

Consistency rules may be an issue, but are avoidable by choosing alternative reward cycles on all challenges apart from the Zero account.

The trailing drawdown, consistency rule, activity rule, and strict news trading rule on the Zero account mean I wouldn’t recommend it. The 1-Step and 2-Step Pro suffer from low value scores due to their 6% maximum drawdown.

I think the best challenge account is the 8% profit target regular 2-Step challenge. With large static 10% drawdown and reasonable profit targets, it delivers solid value for its price. But stay aware of the max loss rule, or you’ll risk a completely avoidable account breach.

Thanks for reading, if you enjoyed check out my YouTube Channel and read more Prop Firm Reviews here.

MetaTrader 5

MetaTrader 5 cTrader

cTrader Match Trader

Match Trader Google Pay

Google Pay Apple Pay

Apple Pay Neteller

Neteller Skrill

Skrill Paysafe

Paysafe