FTMO recently paid out $400,000 to one of its traders after he made a record-breaking $500,000 of profit. My Forex Funds have also been paying profit splits of way over $100,000, and in February paid out more than $6 million in total.

These are currently the two largest online prop firms – an industry that is attracting thousands of traders who are looking to earn more money from their skills. But what is funding, and how do these online prop firms work?

What is a prop firm?

A prop firm is a business where traders are paid to make returns on the firm’s money. In most financial institutions these traders need qualifications and to pass through an extremely competitive process to get the job, then are paid a salary.

How do online prop firms work?

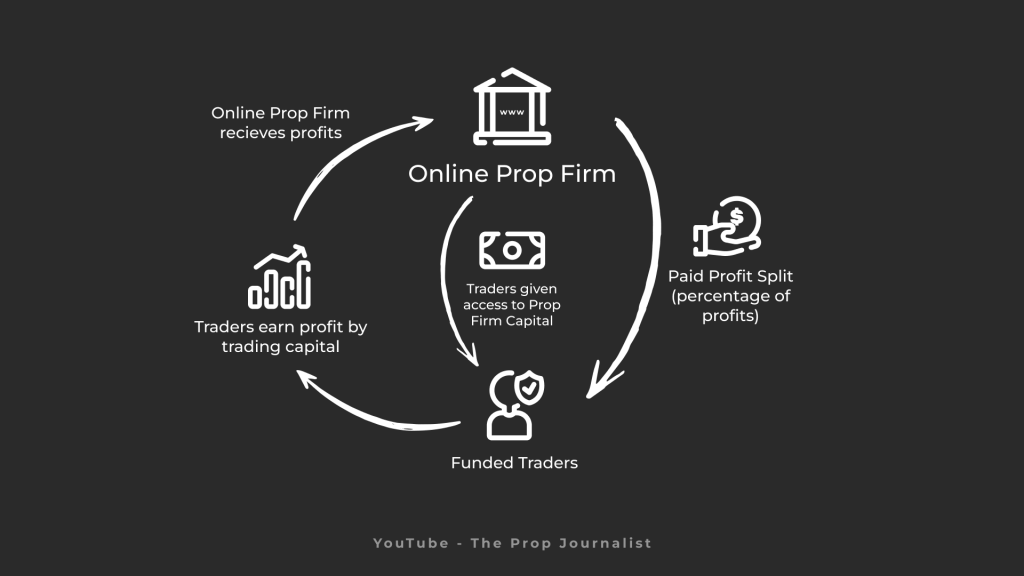

Online prop firms are a little different. Anyone can trade online prop firm capital as long as they pass the evaluation, and funded traders are paid a percentage of their profits, not a salary. However, you must pay to take part in the evaluation process, where the price depends on how large you want your funded account to be. After paying you are given an evaluation account, which is a demo trading account that is used to test a traders ability.

This evaluation is split into 2 phases. In each phase the trader has to reach a profit target on the evaluation account within a time limit, usually 30 and 60 days. The profit target depends on the prop firm, but is usually 8-10% in the first phase then 5% in the second phase. Traders must also not break the daily maximum drawdown of 5% and the total maximum drawdown of 10-12%.

If traders pass this evaluation, they will receive a funded account. This is a trading account filled with the Prop Firm’s money, where the trader is eligible for a percentage of the profits that they make. This profit split is usually 75 to 90%, and paid out bi-weekly or monthly. Most prop firms also refund the evaluation fee with your first profit split, but if you fail the evaluation you will have lost your money. Once funded, as long as you don’t break the drawdown rules you can keep trading the funded account and earning profit splits.

Should you try to join an online prop firm?

The My Forex Funds stats show, that for most traders the answer is no. A majority of the participants fail the evaluation process, and only a very small amount actually earn a profit split and get their money back. This is because lots of inexperienced traders see large profit splits and think earning them will be easy, but fail due to the strict drawdown parameters. You should stay away from prop firms until you have a strategy that you have backtested and proven that it can generate the returns needed to pass the evaluation.

Be patient, and once you are profitable there is a huge amount of money to be made with prop firms. But the more you try to rush the process, the more money you will lose, and the less likely you will be to ever earning a profit split.

Thanks for reading, what do you think of prop firms? Feel free to comment down below.